At a time when U.S. pessimism is running high, Joseph Nye provides a good reminder: America still has plenty going for it. In a recent article for Project Syndicate (“American Greatness and Decline”), the Harvard professor and foreign policy expert pushes back against the perception that America’s greatest days are behind it.

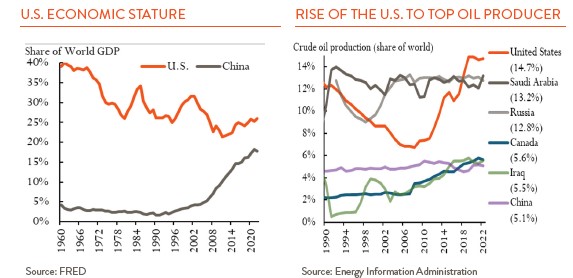

While it may be true that U.S. global economic stature is not as great as during the immediate post-war period, handwringing over relative decline obscures some absolute advantages. Nye contrasts the U.S. with China and describes factors that position the U.S. as a global leader for the long run (see charts at bottom). He is not trying to overstate these advantages but thinks it is important to see them with clear eyes for the boons they are—provided we hold onto them. We might quibble with the durability of each factor, but it is hard to poke holes in the benefits they ultimately offer. Consider the following:

- Geographic ease: The U.S. has friendly neighbors to the north and south while China shares a border with 14 countries and is engaged in multiple territorial disputes. The U.S. also has two oceans’ worth of access to shipping lanes and the supply chains that come with them.

- Energy independence: The U.S. is energy independent and accounts for the largest share (15%) of global crude oil production. Many other advanced economies rely on energy imports.

- Reserve currency for the world: It’s been called an “exorbitant privilege” that the U.S. dollar is the world’s currency. Nearly 60% of global foreign reserves are denominated in dollars, with the euro a distant second at around 20%, according to the IMF. The Chinese renminbi accounts for 2%. The dollar is also involved in 85%-90% of foreign exchange trades, according to the Bank for International Settlements.

- Improving demographics: The U.S. workforce is growing, not shrinking, like it is in China and many developed market economies. The U.S. is the only major developed country not sliding in the rankings of projected global population.

- Cutting-edge technology: Finally, imagine you are a top-of-your-field software engineer. What is the one generative AI company you would apply to for employment? Raise your hand if you had “Open AI” (or another U.S. company). This is obviously not a statistic, but it illustrates how tech dominance can create a virtuous cycle in attracting talent.

These points paint a promising picture for the staying power of U.S. prominence. And while Nye discusses the factors in the context of geopolitics and great-power competition, many are relevant for investing, a field that is all about expectations for the future.

Perhaps the most important is confidence in capital markets. Deep capital markets governed by rule-of-law and reliable corporate precedents help ensure a more stable and predictable environment for conducting business.