Investors were grappling with a lot of uncertainty at this time last year. Covid infection rates remained elevated. With inflation still clocking in at 6%-7%, interest rates seemed poised to march ever higher. Abroad, Europe was struggling with sky high gas prices while the war in Ukraine raged on. Against this backdrop, investment strategists largely expected stocks to struggle through the first half of the year before rebounding in the second half as the Fed, satisfied that the slower economy had translated into lower inflation, cut rates to avoid a recession. How did these forecasts pan out?

While short-term market predictions are notoriously wrong, this one was not terrible. The Fed continued to fight inflation, raising rates another 0.75% between February and May and price increases edged down throughout the year. The majority of stocks, but not all, struggled to make much headway during the first half of the year with the Dow rising just 3.8% over the period.

But much of what really mattered to the stock market in 2023 was not anticipated. Some of the most important factors were “exogenous” in nature. The artificial intelligence (AI) powered chatbot ChatGPT was first introduced to the world at the end of 2022. While its adoption rate was rapid, it took a few months for tech titans like Microsoft, Google and Amazon to figure out how to incorporate the technology into their products. News of its capabilities and anticipated positive economic impact sent shares of these leading tech companies soaring and by the end of June, the tech-dominated Nasdaq, which had been expected to struggle in the face of rising rates, had gained over 32%. The Israel-Hamas war, which began in October, was also unanticipated. To date, global financial markets have largely held steady in the face of the heightened violence, but the added geopolitical uncertainty has set investors further on edge.

While higher rates were largely anticipated last year, understanding the impact that they would have on the economy proved far more difficult. At the beginning of the year, many analysts considered the combination of higher rates and a still expanding economy the perfect backdrop for expanding bank profits. Instead, higher rates led to an unprecedented rise in funding costs that upended most banks’ business models. By July, shares across the sector had fallen over 20% and four banks had failed. Higher rates were also expected to put a dent in consumer spending and lead to declining house prices. But, neither of these things occurred. Thanks to a healthy job market, consumers kept spending while higher mortgage rates worked to restrain housing supply and support prices.

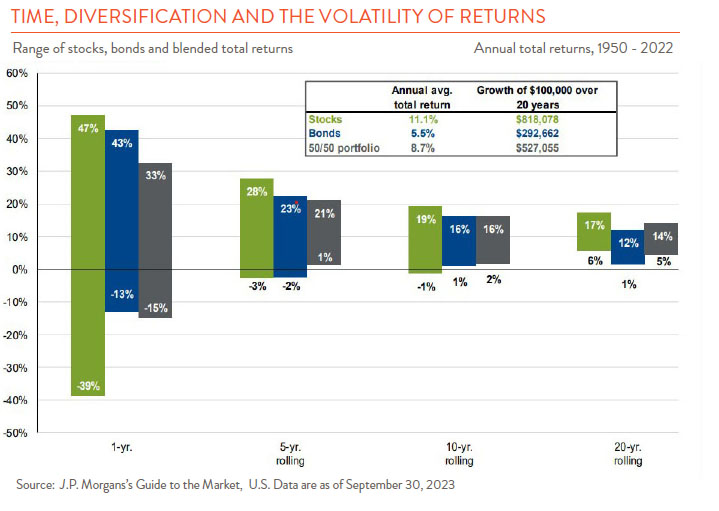

This short review of 2023 is a good reminder that while we spend a lot of energy trying to predict events and control risk in the investment world, our ability to do so is limited. Unforeseen, exogenous forces will always be present. Success too requires both accurately predicting events and their “second order” impacts. So, what is an investor to do in the face of such challenges? First, employ a healthy dose of skepticism when making or employing market forecasts. Stay informed but do not place too much emphasis on any one person’s viewpoint. Second, understand that taking on risk (macroeconomic or otherwise) is a part of investing. Strategies like diversification help to minimize risk, but cannot eliminate it entirely. Finally, try to keep focused on the long-term. Financial markets can experience a great deal of volatility over short periods of time, but as the chart above shows, this volatility becomes more muted the longer the period you have to invest.