We have been writing this newsletter for 25 years now. We are not market forecasters. We don’t try to tell you when to buy or when to sell. We are long-term investors, almost always fully invested. We help clients decide on an appropriate level of risk, stocks versus bonds versus cash, and then we stick with this through thick and thin. We help clients stay patient.

The purpose of the newsletter is to bring you each month interesting perspectives on the market, the economy, and the world. In over 300 issues there are some themes that keep recurring. Some have played out but some, like these three examples, have not.

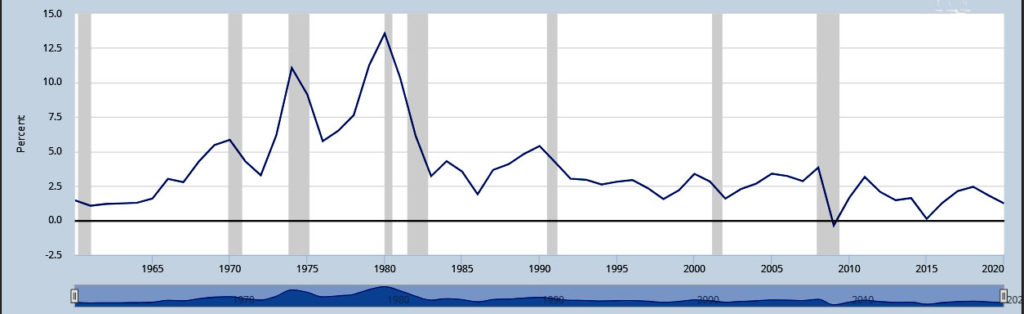

An increase in inflation and interest rates is right around the corner. This has been the most common worry we have written about since 1995. But it hasn’t happened (see chart below). Why? Maybe the reason is globalization, or the decline in unions, or the rise of online shopping. Will we see a reversal now? We don’t know. Some things that are logical and seem “certain” to happen just don’t, or at least take a lot longer than expected.

Inflation, Consumer Prices for the United States

Emerging markets are the future. We thought the original BRICs (Brazil, Russia, India and China) and the fast charging countries behind them (South Africa,Turkey, Indonesia, etc.) would be the future engines of growth and that investors had better pay attention. Well again, this hasn’t played out. Although many emerging economies have had fast growth and most have young populations to fuel future growth, progress has been up and down. What the market got wrong is that sustained economic development depends on effective government, and most emerging economies just don’t have this.

Finally, there is China. No country has developed more rapidly the past half century than China. And no country seems to have more critics. Some argue that authoritarian regimes just can’t last. Others argue that as the Chinese get wealthier, they will demand more personal freedom. Still others argue that the banking system, controlled by the State, is a house of cards loaded with bad loans. And don’t get the critics started on the housing market, which they claim is massively overbuilt and the ultimate Bubble. Despite all this, growth continues.

The one constant in our newsletter the past 25 plus years is that investors are anxious and worried. They were back in 1995, they are today. But you know what? Through all the crises since 1995, the Tech Crash, the Housing Bubble, the Great Recession, etc., the total return for U.S. stocks has averaged 10.4% per year. Our advice: stay long-term and stay patient.