Dropping bond prices have recently caused anguish for many investors, especially since bonds are usually held out as the less risky part of a balanced portfolio. With the U.S. bond market losing more than 9% so far in 2022, it’s natural to wonder if bonds are still holding up their end of the bargain.

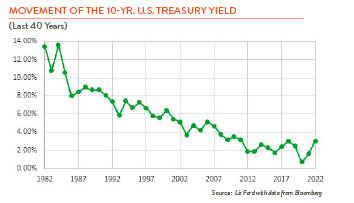

Over the last 40 years, interest rates have fallen dramatically (see graph to the right) and we’ve grown accustomed to bond prices going up, not down. When you buy a bond, you lock in set interest payments. These cash flows get more attractive as new lower interest bonds are issued. While it may be nice to see the value of your bond go up, the interest you earn ends up being a larger component of your total return. With lower yields we’ve been forced into accepting less compensation for tying up our money.

Many have opted to spend their money instead, contributing to our current inflationary woes. The Federal Reserve’s recent rate hikes are intended as a counter measure. More raises are expected this year, and it’s tough to predict how high rates will go. Since the 1980s we’ve tended to overestimate how much rates will rise, but this time may be different. Recent lower prices likely reflect at least some of this uncertainty.

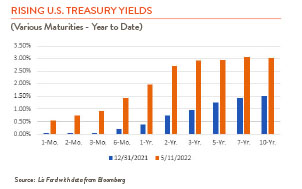

Our long-term strategy has been to see bonds as a diversifier to stocks, a source of liquidity, and an income generator for portfolios. Favoring stability, we try not to get “too cute.” We avoid speculative credits and high-turnover trading, opting to buy high quality corporates, municipals, and treasuries and hold them to maturity (whether in individual bond ladders or buy-and-hold bond funds). With this approach, bonds are continually maturing and can be reinvested at new rates. Rates have risen dramatically this year (see graph below), and higher interest payments should help normalize bond returns over time.

We’re also encouraged by recent research at Vanguard supporting the continued value of bonds as a diversifier to stocks. Over the last 30 years, the correlation between stocks and high-quality bonds has been low (bonds moved in the same direction as stocks, but less dramatically) and often negative (bonds moved in the opposite direction of stocks). This has persisted in both high and low-rate environments and the goal is to mute portfolio losses if equities fall.

While we do track market fluctuations, our focus remains on analyzing credit quality: the ability of issuers to make interest and principal payments and avoid default. We look for solid issuers trading at reasonable prices relative to the market. Lower quality issuers can feel the negative effects of rising rates more acutely, and historically investors have tended to seek shelter in high-quality bonds during times of market stress. We also prioritize parts of the yield curve where we think investors are being properly compensated for increasing time to maturity.

Bonds still make sense to us but finding suitable yield for clients has been an ongoing challenge, especially as inflation has increased. Falling bond prices may sting now but earning a more rational rate of interest for our time and money should prove to be a welcome change in the long run.