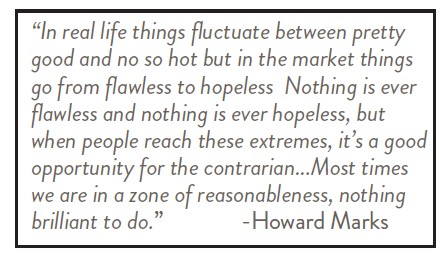

The stock market is very much like Patty Griffin’s lyric. There is an excess of short-term noise on Wall Street. The nuggets of important wisdom get lost in the daily waterfall of information. A valuable source of enduring Wall Street wisdom is Howard Marks, the co-founder of Oaktree Capital, the largest U.S. investor in distressed securities. Marks knows the rhythm of the markets. At 76 he has published two books and, since 1990, written periodic investment memos to clients and friends.

In these uncertain times with inflation high and interest rates rising, with war in Ukraine and an uncertain economic outlook in almost every country, I thought it would be helpful to share three pieces of Marks’ wisdom.

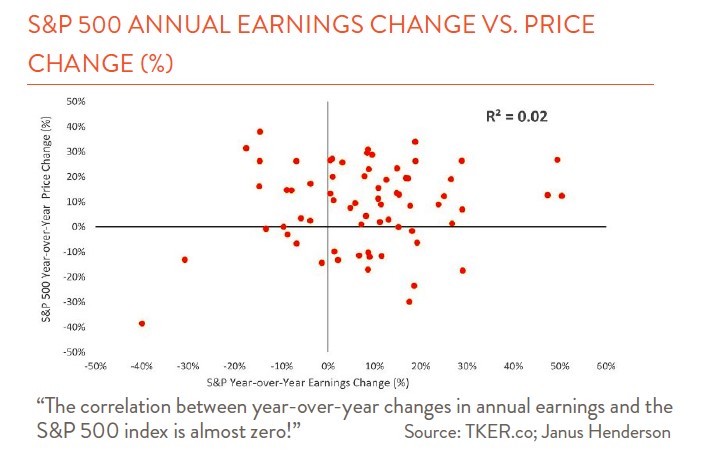

The first is that macro forecasting is virtually impossible. Forecasting involves so many variables you just can’t get all the pieces right. We are all interested today, for instance, in what will happen in 2023. Will we have a recession, and if we do, how will this affect corporate earnings and the stock market? You would think if corporate earnings fell next year, that stock prices would also. But Aneet Chachra a portfolio manager at Janus Henderson has looked at year- over-year changes in corporate earnings versus the change in stock prices. The evidence shows (see chart above) no short-term correlation between earnings and stock prices. So be careful of forecasts.

A second piece of wisdom is, forget trading. Look at the market as Warren Buffett does: you are buying pieces of companies when you buy stocks. Owners of businesses don’t buy and sell their companies every six months as investors often do with their stocks. As Marks says, “you don’t make money on what you buy and sell. You make money on what you hold. Think more. Trade less.”

The third piece of investment wisdom is that true investment success is success over time. Going back to Chachra, research found that even though there is no correlation between year-over- year changes in corporate earnings and subsequent stock price changes, over the longer term the correlation is very strong. Corporate earnings have gained 8% per year when measured over 10 year periods. The stock market has tracked this exactly, up the same 8% per year. So focus on the long term.

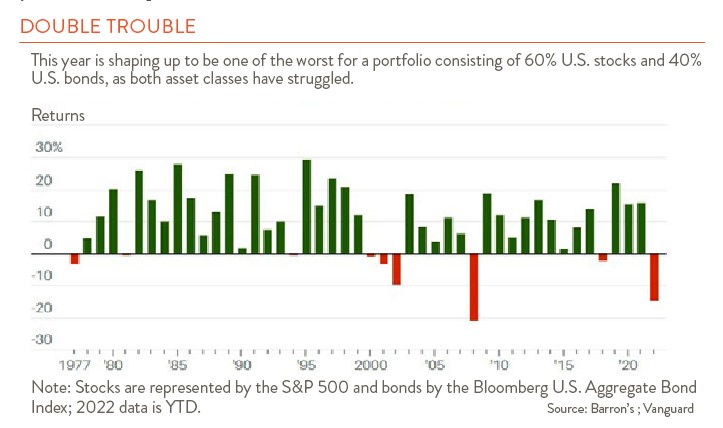

One last comment. Long term investment wisdom will not win year in and year out. Short-term results often seem to disprove long-term strategies. One example is the 60% stock/40% bond strategy. In normal times when stocks go down, bonds function as a stabilizer, cushioning losses. But this year both bonds and stocks have declined, and some investors are giving up on a tried and true allocation just because short-term results are negative. Don’t be put off here, if your allocation preference is 60/40, stick with it. As they say, don’t just do something, sit there.