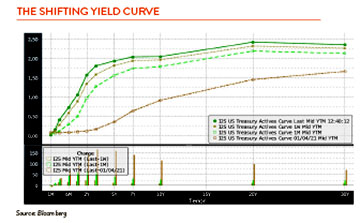

I am talking about the value of making market predictions. The yield curve (see chart) is rising now, meaning short-term rates are moving higher and long-term rates also. Starting from the bottom, the lines represent the yield curve at the beginning of 2021, a month ago, a week ago, and today. The point is rates are going up, reacting to worsening inflation and the expectation the Fed will begin ratcheting up short-term rates in March.

Rising rates get investors nervous and today’s rise may indeed signal an economic slowdown or even worse, a recession. The long knives are out now, sounding the alarm of a stock market collapse. Jeremy Grantham, one of the deans of the Boston investment community, says we are now in a “super bubble” with the potential for “the largest markdown of perceived wealth in U.S. history.”

Well first let’s add some caveats. Jason Zweig, a columnist in The Wall Street Journal, recently wrote a mea culpa in his Saturday column. In January 2010, a nationwide survey found that individual investors thought the market would return an average of 13.7% per year over the next 10 years. Because the stock market’s price to earnings ratio was then above its long-term average, Zweig argued that a return of 6% was a more sensible expectation than 13.7%. Well, the return actually came in at 13.6% per year, almost to the decimal point of the survey. Predicting the future based on past data, no matter how rational your arguments, can be way off.

Today, price-to-earnings ratios are even higher and further from the average than they were in 2010, so you can see where the doomsday scenarios are coming from. But making a radical change to your investments based on one’s very limited ability to see the future is dangerous.

Every year Barron’s, the financial weekly, features a 14-question multiple-choice contest asking readers to predict such things as where the market will end the year and which Dow Jones 30 stock will be the biggest gainer and loser. The maximum possible score in the 2021 contest was 17 (some questions were worth two points). The average score was 3.74, which in college wouldn’t even get you the proverbial “Gentleman’s C”.

My advice today is if you must, trim some of your U.S. stocks, add to international stocks or bonds to be fully diversified, and then, just breathe deeply. Predictions are fun but they can be very dangerous.