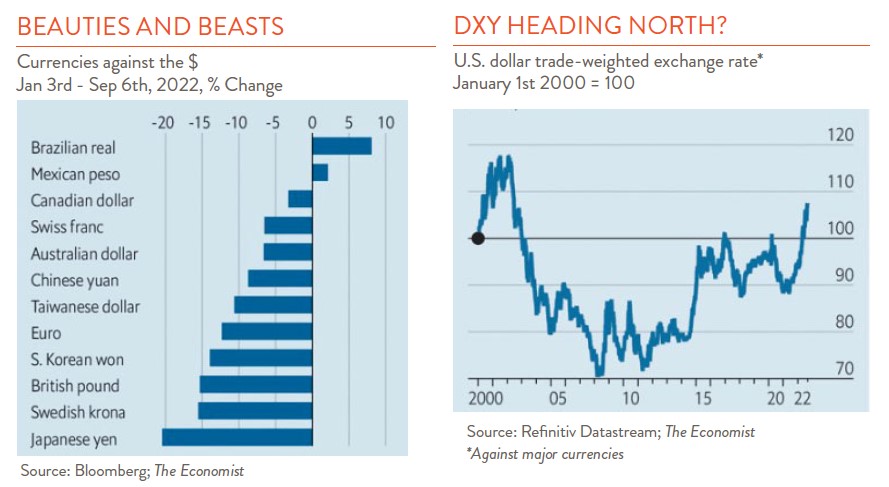

Dust off the passport. We are goin’ traveling. The dollar is stronger today than it has been in 20 years. Now is the time to go. This year alone the dollar is up 15% against a basket of world currencies, and for the first year in ages the dollar is worth more than the Euro.

What accounts for this strength? Historically, the dollar has been the butt of all currency jokes. Our trade deficit is enormous, our productivity is in decline, our budget hasn’t been balanced in who knows how long; it is just a matter of time before China and others start to dump the greenback and then all you-know-what will break loose.

The good thing is it isn’t Armageddon just yet. The Fed is increasing rates aggressively to thwart inflation, and this is attracting investment funds from abroad. Our economy may be questionable, but China, Europe, and others are even more questionable. So, we are attracting investment capital. And finally, in times of stress, investors flee to the strongest player. America has its problems but as they say, in the land of the blind the one-eyed man is king. We might look a bit disheveled, but relative to the competition we are not bad (at least for now).

As with any coin, however, there are two sides. Here are some of the problems. Not everyone is benefitting from a strong dollar. U.S. manufacturers are at a disadvantage today to foreign competitors who can sell far cheaper here. And U.S. multinationals, who have significant sales abroad, lose when they translate their profits back into (fewer) dollars for reporting purposes. Abroad, emerging economies are reeling from the extra cost of servicing their dollar borrowings.

A second problem is the currency market is notoriously cyclical. If it swings one way, it will eventually swing back the other. So, what could cause the dollar to weaken? If inflation started to cool, the Fed could back off rate increases, cooling foreign appetite for our securities. Conversely, if other countries started to raise interest rates more aggressively, investors would see less need to buy dollars to invest here.

And then there are those nagging global political questions. Oil is priced in dollars globally, and if oil prices came down, so would demand for dollars. Finally, war is always in the picture. The Ukraine confrontation is causing shock waves around the world, but the mother of all conflicts is something happening in the Pacific. Who knows what would happen to the dollar if China and the U.S. got embroiled in a conflict over say, Taiwan?

But for now, it is happy sailing — or flying — abroad. You don’t have to starve yourself in Europe anymore. And for us Vermonters, the Canadian border is fully open again, and a Montreal Canadiens hockey ticket is that much cheaper. Bon voyage.