Federal Reserve efforts to tame inflation through steady interest rate increases seem to be having their desired effect. But the last two years have been tough on investors with both stock and bond prices experiencing unprecedented levels of volatility. Against this backdrop, it is no wonder that money market funds have gained broad appeal. Last year, the asset class attracted more than $1 trillion in new funds globally thanks largely to yields which now regularly exceed 5%.

So, what’s not to like about a 5% return on an asset class that bears little, if any, risk? First, let’s think about that 5%. This number, referred to as the nominal rate, represents your return before inflation. Inflation today is running close to 3%, so the real, or after- inflation rate, is a much lower 2%.

Second, attractive money market fund yields may not last forever. The Fed has already signaled that it might begin cutting short-term rates this year. While opinions differ on the extent of the reductions, the bond market today is forecasting a total of six cuts concentrated in the back half of the year. If things turn out as expected, these reductions will quickly translate into lower money market fund yields. That said, forecasting interest rates is notoriously difficult, and events rarely turn out exactly as planned. Money market yields could stay at current levels or even edge higher if inflation fails to decline further.

Investors should also consider the opportunity cost of investing in a money market fund. Cash, the lowest returning asset class, is not a suitable choice for achieving inflation-beating returns over the long term. Stocks and bonds, despite their volatility, have historically had much better real returns than cash. While safe, an over-allocation to cash could leave you missing out on the stock and bond upside. Cash is, however, an excellent choice for meeting short-term or emergency funding needs. How much is best? Advisors typically recommend three to six months’ worth of living expenses, but the amount can vary based on personal circumstances. Beyond that, the allocation becomes a strategic one that should be considered carefully.

The good news is that higher rates mean the outlook for bonds is now more attractive than it has been for some time. The “risk-free” 5- and 10-year Treasury notes, for example, both currently yield around 4%. Locking in these rates by extending the maturities of your fixed income investments will help protect you if the yield on cash declines.

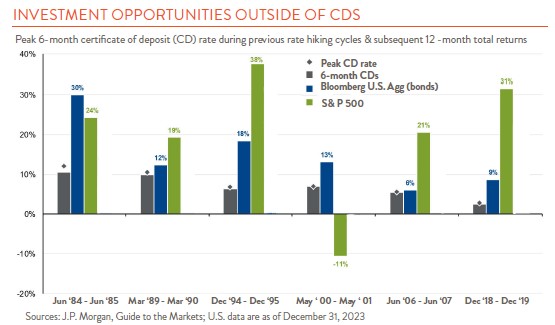

Finally, if you need further encouragement to reduce excess cash holdings, consider the chart to the left. In five of the past six periods when interest rates peaked, returns from both bonds and stocks over the next 12 months exceeded the returns from a short-term CD investment. Past may not always be prologue, but in the investment world it is often worth keeping in mind.