China has a lot to boast about. Since economic reforms were put in place by Deng Xiao Ping in the late 1970s, China has lifted more people out of poverty (800 million) in a shorter time than any country has ever done in history. Visit China today and you will marvel at the futuristic skyscrapers, the all-electric cars and buses, the 25,000 miles of high speed train lines, and the dizzying array of food.

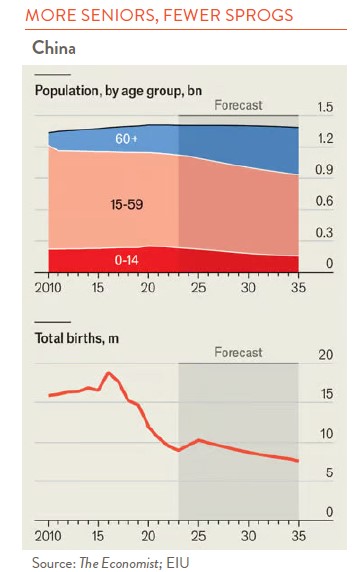

But development has also brought problems. China’s one child policy, which restricted urban families to one child, was put in place in 1980 and remained in place until 2016. It did its job but in retrospect, it did it too effectively (see chart). Today, China has too few young people while the elderly are living longer, retiring earlier, and costing more.

A woman working in manufacturing can retire at 50, and if she works in an office, 55. A man typically retires at 60. These are really early ages compared to workers in the West. It is estimated that the national retirement fund, which is not that generous to start with, will run out of money by 2035. China needs older workers to stay in the economy longer.

Raising the retirement age is never a popular move regardless of the country. When France proposed raising the retirement age this year there were riots across the country. China is proposing some mini steps now to solve its retirement/workforce problem. The retirement age for women will go from 55 to 58 and for men from 60 to 63. These changes will be phased in over 15 years. So far, the public blowback has been muted. One reason is the draconian control the government has over the internet and public opinion. It can simply delete criticism. The other reason is that China’s elderly remember the privations of their youth and the Cultural Revolution and tend to be the “suck-it-up generation.” Younger workers retiring later may not be so accepting.

Chinese lifespan has gone from 35 when Mao took power to 77 today. Health care costs and retirement benefits are going to soar in China in the future. Where the revenue is going to come from to cover these costs is the big question.

China has no property tax (let me repeat this for American readers: no property tax!) and a very underdeveloped income tax. Whereas Western countries on average raise nearly 40% of their revenue from the income tax, China raises just 8%. China has historically relied on a value-added tax, a Social Security-like system whereby companies and workers each contribute to a health/retirement fund, as well as the sale of land to developers to provide revenue. With the glut of unsold apartments nationwide now, there will be little revenue from land sales in the immediate future.

China wanted to develop, and it has. The problem now is that the government has acquired all the problems of the West – too little tax revenue and too many expenses. Welcome to the economics of affluence.