Back at the end of October, Barron’s posed the question, “Is China Investible?” The MSCI China Index had gone nowhere for over 25 years, GDP growth was stagnating under the weight of the zero-Covid policy, the property market was teetering, and the government was clamping down on private entrepreneurs. There was little doubt these policies would continue since Xi Jinping had stacked the Politburo with his cronies. Time to give up on China?

Even fans of globalization like us were starting to waver. But then we learned the hard lesson that we have had to learn so many times before. It is so difficult to predict the future. It is far better not to try but to establish a sensible policy for allocating your money between things that will grow and things that are stable, domestic investments and international ones, and then just sit tight.

On December 7, China forced everyone to rethink their forecasts. It lifted its

zero-Covid policy, which was the chief cause of its recent on-again, off-again economic results. It loosened lending to the beleaguered property developers and started to talk nice again about the private sector, the biggest driver of job growth. Pragmatism was back.

We are now anticipating faster Chinese growth this year, which should help the global economy. The lesson is, be careful with your predictions. Life can change quickly.

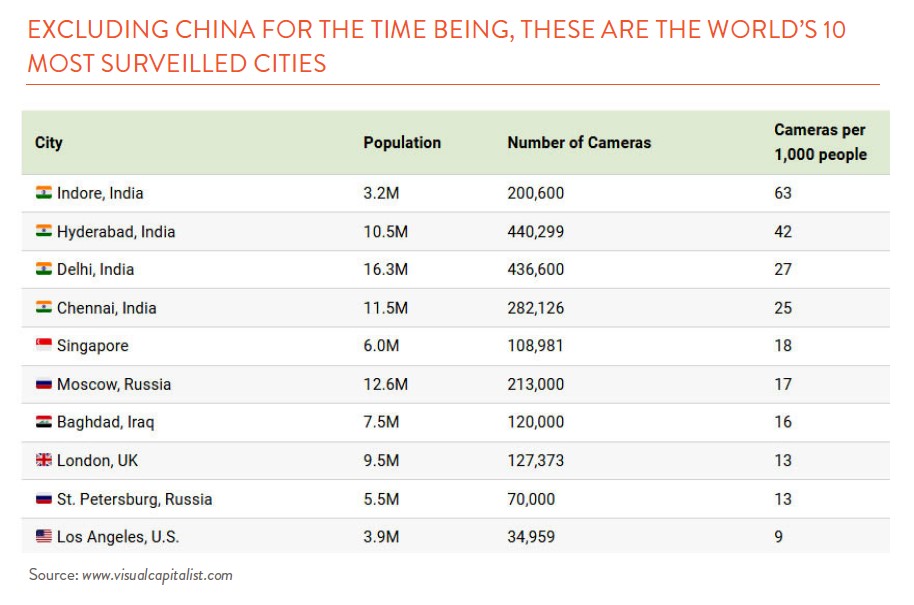

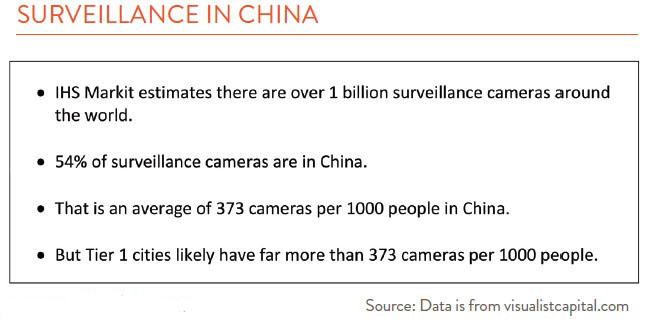

The Chinese populace will be relieved they are free from Covid-related surveillance, but China’s extensive and eerie surveillance infrastructure remains very much in place. Take a look at the charts here. Los Angeles has nine surveillance cameras per 1,000 people. The average Chinese city has over 370. I used to tell people, “the national bird of China is the construction crane.” Turn in any direction and you will see these symbols of growth. Now turn in any direction and you will see a battery of shiny surveillance cameras looking straight back at you! 1984 redux.