From decentralized utopia to meme coins and manias, fraud and crashes, and political grift, crypto has come a long way from its genesis. And yet, it endures. In fact, it’s back on top of the world, with Bitcoin near its all-time high versus the U.S. dollar. For our part, while the use cases of the technology and legitimacy have grown, we have yet to identify characteristics that give us comfort in crypto’s inclusion in an investment portfolio.

In the foundational 2008 whitepaper on Bitcoin, the pseudonymous Satoshi Nakamoto wrote, “What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.” Well, those pesky third parties—in this case, banks and governments—are now firmly in the mix, having recognized a profit opportunity and co-opted that original decentralized vision. Crypto is mainstream.

Major asset managers offer crypto exchange-traded funds, and big banks have brought some of the financial market plumbing on to the “blockchain” (the tech underlying crypto). Ironically, one uses the tagline “technology you can trust.” The new Administration has endorsed the industry, and the Treasury is pushing for regulation to promote the use of “stablecoins” (more below). Even the president has a meme coin, minting his family billions as speculators sought to buy a piece of…we’re not sure what…plus a dinner for the top buyers. Mr. Nakamoto seethes under his pseudonym.

Does mainstream mean crypto is investable? Our view is that while the use cases of blockchain technology have mushroomed, and some are indeed useful, we are still not comfortable putting other people’s money to work in cryptocurrency markets.

More generally, we tend to view crypto in three ways: 1) the useful technologies, 2) the potentially harmful morass of speculative meme coins, and 3) the core “blue chips.”

The useful stuff is the innovation enabled by the technology —the distributed ledger and blockchain. Without getting into specifics, they enable things like payments without the need for parties to be identified by (and pay) a bank. This was the original Bitcoin dream of cheaper, decentralized financial transactions. There is plenty of potential for criminal activity, but it’s also easy to see the benefits of removing the middleman.

Stablecoins are a newer innovation that build on this technology, where a coin is pegged to something with more broadly recognized and supported value than a cryptocurrency, like U.S. Treasury securities. This basically enables dollars to be sent over crypto networks. That is useful because Bitcoin, for example, is just too volatile as a currency, and many of us still have a need to transact in dollars.

On the other end of the usefulness spectrum, is the speculative, grift-ridden world of meme coins. Examples include Dogecoin, Shiba Inu, OFFICIAL TRUMP, and Fartcoin—each with over $1 billion in market capitalization. This area feels like a pure casino. Our advice here: buyer be well-ware.

Then there are the “blue chips”, the core cryptocurrencies like Bitcoin and Ethereum. Of the coins one might buy for investment purposes, these are more proven with longer histories, larger networks, and greater liquidity. They have grown in legitimacy and many promote them as financial asset holdings. We’re not there yet. The problem for us is that we don’t understand what effect Bitcoin will have on a portfolio.

We are, generally, bottom-up investors. We like to read financial statements and get to know businesses before we buy them. We like to understand the risk and return profile of what we buy. We are okay with gold, even though it does not generate cash flows, because gold is a well-proven store of value and safe-haven hedge against “policy error.” It has a long history of outperformance when the world becomes less stable. Bitcoin has picked up a similar “digital gold” reputation for itself, but it just does not seem to behave like gold.

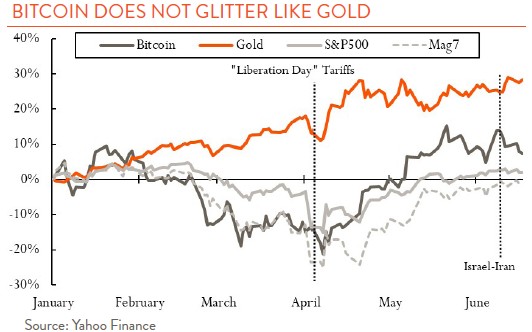

The chart below shows year-to-date returns for Bitcoin, gold, and risky assets like the S&P 500 and the “Magnificent 7” mega cap tech stocks. Bitcoin looks way more like stocks. And whereas gold functioned as a safe-haven during recent market turmoil, Bitcoin sold off along with equities.

At the end of the day, we’re still left puzzling over what drives Bitcoin’s value. That story is still evolving, and in the meantime, it is prone to speculative manias and crashes. It is clear crypto is not going away, but we probably need to see a longer track record of stability and clearer demonstration of its role in a portfolio before we feel comfortable investing.