Clayton Christensen, the Harvard Business School Professor who died much too young in 2020, was one of the most important business thinkers of his generation. One of his breakthrough observations was that of “disruptive innovation,” the idea that existing producers of goods, after they become successful, are inclined to move up the value curve to higher-margin, more profitable goods and leave the lowest rung open to new competitors. These new competitors then cut their teeth on entry-level products, eventually becoming established in their own right. Think of the post-WWII car market. Detroit concentrated on bigger, more expensive cars, allowing the VW Beetle, Toyota, and Datsun (remember that name?) to enter the low end of the market. The new entrants eventually moved up to challenge the Big Three at every price point.

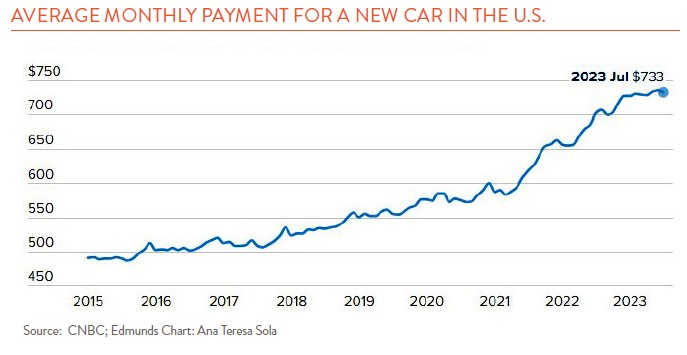

What got me thinking of this was a recent story from CNBC that noted there is only one new car model in the U.S., the Mitsubishi Mirage, that has an average transaction price under $20,000. The auto industry is pushing the consumer up to models with more bells and whistles, which in turn have a much higher, more profitable price tag. The consumer is not necessarily objecting to this since they are doing the buying, but the loan that has to be taken out to get into those cushy, heated seats that adjust 17 different ways is eye popping (see chart below). There are now 32 vehicles on the U.S. market that sell for an average price of more than $100k compared to 12 models five years ago. And these 32 models don’t include the “super exotics” like Rolls Royce and Ferrari.

So, who might be the innovative disruptor of the car market in the future? A good first guess might be the Chinese who are eagerly eyeing the global car market. You can’t be a big player in this market without being in the U.S. There are two problems here, however. The first is political. With U.S.-China relations where they are today, will Washington really allow Chinese cars to be sold in volume in our market? A big question mark. The second problem is that China has ceded the gas engine car market to Western manufacturers and the Japanese and Koreans. They are focusing all their attention on electric and hybrid vehicles.

It looks today as if China could send the U.S. a lot of cheaper EVs and hybrid cars, but will the mainstream U.S. buyer in the near term give up his love of the gasoline engine and embrace EVs? The Chinese have a lot of hurdles to clear before they can be successful in the U.S. In the 1950s and 60s, everyone said of the Japanese, “Sure these cars are inexpensive, but they are junk and will fall apart in a year.” But this is what disruptive innovation is all about; facing what looks like insurmountable problems, getting your nose under the tent flap, building your brand, and moving up the value curve. Keep your eye on the Chinese and the low-end auto market.

Another interesting car-related article was in The Economist recently. It discussed car models most likely to be stolen in urban areas today. High-end models and dependable SUV workhorses from Toyota or Nissan are not the ones that are most often targeted. It is actually two Korean models, the Kia and Hyundai, that are most often stolen. So many in fact (see chart above) that Chicago and six other cities are suing the manufacturers. Past models of Kias and Hyundais do not come equipped with radio key fobs which immobilize the ignition and significantly reduce the chance of theft. Chicago argues that by not including these low-cost features, Kia and Hyundai have directly encouraged other crimes. As The Economist notes, if you are considering a drive-by shooting or a robbery, what better way to do it than in a vehicle that cannot be traced to you.