No – nobody is dumb here. We are just trying to simplify the complex U.S. economy. Real economic growth (growth after taking out inflation) is what drives hiring and corporate profits, allows for wage increases, and spurs the stock market. It’s important. So an obvious question is, what drives economic growth?

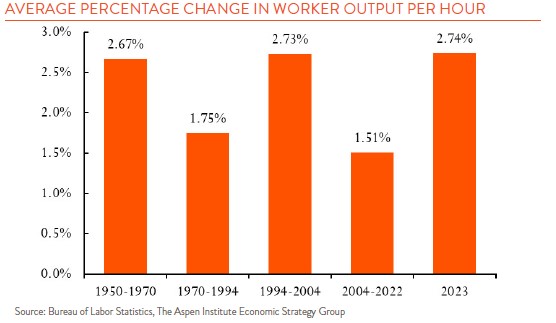

It is a function of just two factors (here comes the simplification): growth in population/labor force and growth in productivity (the increase in what a worker can produce in an hour). If you have more people working and they are producing more per hour, you will get a growing economy. In the past (more simplification here), in the U.S., you could generally count on 1% per year growth in population/labor force and a 2% per year increase in productivity, giving us the historic longer-term 3% annual economic growth rate.

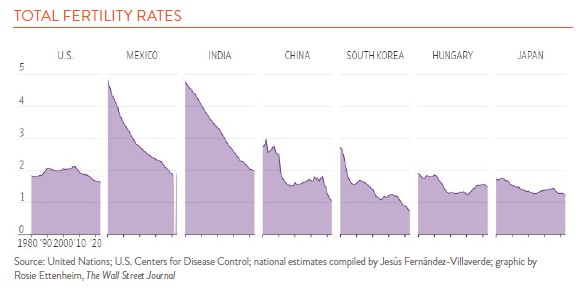

Now comes the problem. Population and productivity are no longer growing at their historic rates. Across the globe women are having fewer children. Jesus Fernandez-Villaverde, an economist specializing in demographics at the University of Pennsylvania, estimates that the worldwide fertility rate (the number of children women expect to have) fell below the replacement level of roughly 2.1 last year for the first time in history. It’s happening in the U.S. too. After holding fairly steady at 2.0 for a number of years, the U.S. fertility rate fell to 1.63 last year.

Population and the size of labor force is also affected by immigration. There are 32 million documented foreign-born people working here and another estimated 10 million undocumented. The U.S. is blessed, or cursed according to some, with plenty of immigration demand. People want to come here. We could offset our lower birth rate with increased immigration. But this debate goes well beyond economics. It is fraught with politics. No easy answers from us.

Productivity is harder to predict than population. It can blow hot or cold for extended periods (see chart right). The good news is that after two decades of poor performance, productivity in the U.S. is rising again. The optimists say AI and a dramatic increase in new business formations post-Covid will fuel long-term improvement. The pessimists fear that high inflation and high interest rates, along with unpredictable domestic policies, will cut short the recent productivity gains.

Higher productivity and overall economic growth is important, not only for jobs and wage increases, but also for dealing with the high interest payments on our national debt and for funding the increasing demands on Social Security and Medicare. Root for labor force growth and productivity.