In every election since we’ve been in business, we get questions—anxieties, mostly—about who will win and why it will be disastrous for stocks. Anne summed it up nicely in the title of an article she wrote during the 2020 election cycle, “It’s not just about who sits in the oval office.” This year has been no exception.

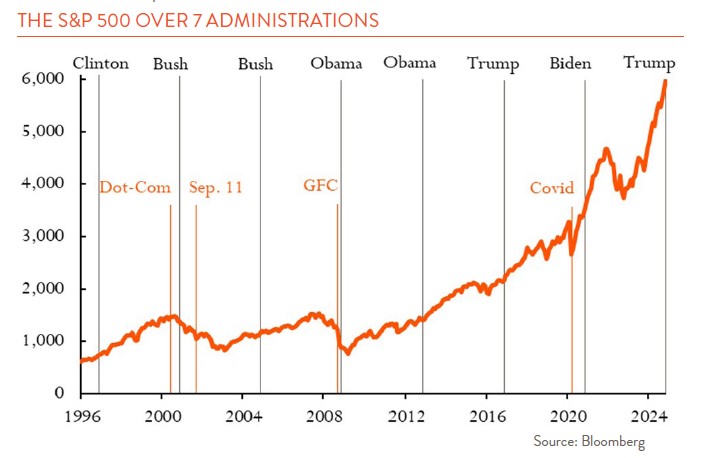

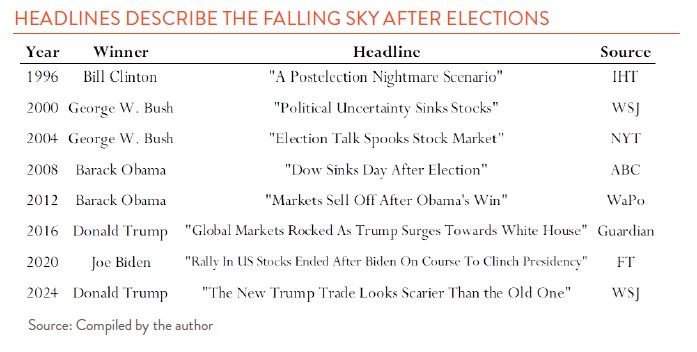

Our predictable response (at least to long-time readers) remains to hold the course and stay invested in the stock market. And yes, after this election too, we continue to believe that long-term investment in equity markets will outperform any short-term market timing attempts. For perspective, we need only zoom out. The chart below shows the S&P 500 index cruising along to an average annualized 10% return (assuming reinvestment of dividends) since we started out. There happens to be the name of a president at the top of the chart every four years, but the stock market did not seem to care which name it was. For an added dose of perspective, look at the headlines surrounding every election in the table – do those sentiments feel familiar?

The point is, while we have never been here before, we’ve been here before. And when planning for our financial futures it is important not to let the emotion surrounding our political affiliations cloud the outlook for market returns. Financial markets do not seem to care about our own preferences. They care about the environment and conditions for companies to flourish and grow – things like productivity, geopolitical stability, technological innovation, population growth, taxes, trade, and tariffs.

The truth is, we seldom know with any precision how a particular candidate will end up influencing the factors in the list above. There are many steps between ephemeral campaign promises and implemented policy – though this can be easy to forget when looking at the reactive price swings in stocks post-election. While President Trump has made many promises, including higher tariffs, he may back down from some of those ideas given his broad backing and courting of business leaders. Other campaign promises may come to fruition, but recall that the U.S still lacks a border wall with Mexico despite vigorous campaigning in 2016. Additionally, President Trump and the Republican party may control both chambers of Congress, but historically control over all three bodies only lasts until the midterms. This would also limit President Trump’s ability to deliver on his multitude of campaign promises.

Much better, in our view, to respond thoughtfully to concrete action than to engage in knee-jerk speculation. While historical returns do not predict or ensure future ones, we remain confident in the long-term prospects for equity markets even as our society remains divided. Over the previous 28 years, we’ve experienced many contentious presidential elections, including Bush/Gore in 2000 which was not decided until December. We also had the dot-com boom and bust, 9/11 and the war on terror, the global financial crisis, and the pandemic. Despite these events, it was an amazing 28 years to be invested.