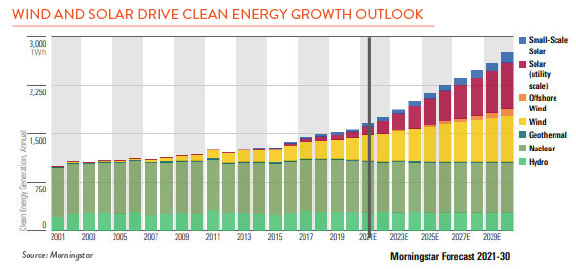

The Biden administration has laid out some aggressive goals to reduce greenhouse gas emissions. Among other things, these objectives aim to have “clean” energy (wind, solar, hydro, etc.) produce 80% of the nation’s total energy generation by 2030, up from approximately 40% today. This target follows on the recently rejoined Paris Agreement’s stated aim for net zero global emissions by 2050. While these sorts of goals have been promoted for years, a growing global consensus fueled by recent extreme weather events is beginning to take them more seriously.

Electric utilities which link energy producers and consumers will drive much of the global trend toward decarbonization. Electric generation accounts for one-third of U.S. energy sector carbon emissions so it is an obvious place to start. Happily, the industry has made good strides already with electric power emissions having fallen 39% from their 2008 peak. Increasing the use of renewables, using more natural gas, and retiring coal plants have all helped achieve these reductions.

While we applaud these efforts, several questions remain. Will the sector be able to meet these targets? Utilities play an important stabilizing and income producing role in many investor portfolios. With that in mind, what impact will this energy transition have on utility profits? Finally, for the socially conscious (ESG) investor, can the utility sector ever truly reach “green” status?

Meeting the Paris Agreement’s net zero emissions target by 2050 will be a challenge. According to a Princeton study, decarbonization here in the U.S. will require between $4-$6 trillion of new capital. Fortunately, U.S. consumers should be generally willing to fund these investments over time as electric bills typically make up a relatively small share of household spending. But other obstacles loom large. These include the reliability of green energy sources such as wind and solar, the additional land many renewables require, and an uneven regulatory process. Thanks to these and other constraints, most studies consider targets of 50%-65% renewable generation by 2035 more realistic.

Progress toward these goals will depend greatly on public policy. Fortunately, the growing demand for clean energy from both residential and corporate customers is fueling supportive regulations and the utility industry’s decarbonization efforts. According to the Renewable Energy Buyers Alliance, Fortune 1,000 companies in the U.S. are expected to increase their renewable energy demand eightfold by 2030. In the U.S., state level renewable energy mandates and federal tax credits have helped drive the expanded use of renewable energy. Today, 30 states have passed legislation requiring distribution utilities to supply a specific percentage of renewable energy to their customers. These mandates generally allow utilities to recover their capital costs and earn a reasonably attractive rate of return on green investments. Utilities operating in states with these favorable structures (e.g., California, Illinois, and New York) should continue to enjoy profit tailwinds in the years ahead.

Finally, there has been much debate about whether energy producing utilities can ever be considered “green.” The transition to a carbon-free economy will take lots of time and money. Until then “dirtier” energy sources like natural gas will likely remain important bridge fuels. Investors committed to a no-carbon mandate may find this exposure unacceptable. Others who view the path to decarbonization more flexibly may be able to reconcile the short-term exposure as a necessary part of achieving their longer-term goals. As always with ESG investing, investors need to both be clear on their own goals and read the fine print to understand exactly what they are getting.