After an historically fast and furious campaign of interest rate hikes to combat inflation, the Federal Reserve is ready to cut at its meeting this week. Why are cuts coming now, and what do they mean for you and me?

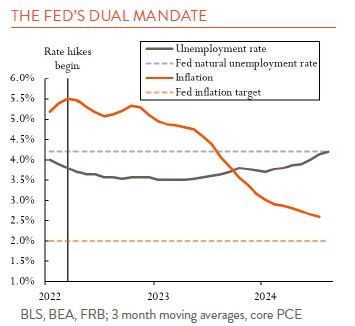

The Fed is all about its “dual mandate” of price stability and maximum employment. They define a specific target for inflation of 2% and an unemployment rate that should be whatever is “natural” for the economy and supports stable prices – somewhere around 4.2%. When inflation took off in 2021 and 2022, unemployment was very low, and the Fed focused all its efforts on bringing inflation down by raising rates from 0.0% to 5.5%. Inflation has since fallen close to the 2% target, but a consequence of restrictive interest rates was that unemployment began to climb. The chart above shows the give-and-take of the Fed’s dual mandate since it first raised rates.

Now the Fed wants to ease up on its policy to make sure the labor market does not weaken further, potentially causing a recession or unpleasant slowdown.

That means it is ready to cut rates. By how much is still an open question. Typically, the Fed hikes and cuts in 0.25% increments – and if that sounds small, it is! But more important than what 25 basis points (as 0.25% is called) might do for the economy is how the Fed proceeds with further rate cuts in subsequent months over the so-called “cutting cycle.” Currently, the market is betting on a 0.25% cut in September, an additional 0.75% by December, and then another 1.5% over the course of 2025. That would bring rates down to around 2.75% over the next 15 months to just about where the Fed deems its policy is “neutral,” neither restrictive nor accommodative for the economy.

So how does that impact us? We can’t take out loans from the Fed or deposit our savings there. Ah, but banks can. It is the very short-term rate – overnight, actually – for banks and asset managers that the Fed controls. And if banks can no longer earn 5.5% on money deposited at the Fed, they can no longer offer similar rates to us.

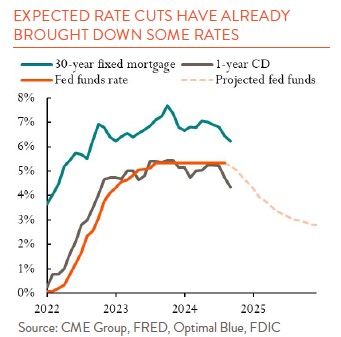

Lower yields on many consumer finance products are probably the first thing many of us will notice over the course of this rate-cutting cycle. High-yield savings accounts, money market funds, and CDs that have all earned around 5% since 2023 will drop with each Fed cut. Actually, CD rates have already come down, especially for longer terms. After all, a bank is not going to promise to pay you 5% for the next year when it might earn only 3% on that money by the end of the CD’s term. Many who have been more heavily invested in cash may now turn to riskier investments like bonds or stocks for their higher return potential.

Just as savings rates will come down, so too will borrowing costs. Anything tied to the “prime” rate or SOFR (the new LIBOR) will also decline with Fed cuts – things like credit cards, student loans, home equity lines of credit, and adjustable-rate mortgages. Even 30-year fixed rate mortgages are affected, though the mechanism is much less direct. In fact, mortgage rates have already declined from around 7% at the start of the year to nearly 6% today. Lower mortgage costs could do much to stimulate the housing market and bring out some of the homeowners currently “locked in” to their homes at much lower, pandemic-era interest rates. The chart above shows how mortgages and 1-year CDs have moved with, and in anticipation of, Fed policy.

While we can talk with certainty about how some interest rates will adjust with Fed policy, there is no such certainty about the broader impact on the economy and outlook for recession. We’re still digesting the impact recent rate hikes have had! Monetary policy is always a live experiment.