In 600 words I am not going to try sum up Generation Z, those born between 1997 and 2012, who are now aged 12 to 27. But I will lay out a big concern about them and also a big reason to be heartened.

First the concern. Gen Z is the first generation to grow up entirely in the smartphone age. Social media, video gaming, Reddit, You-tube, etc. rule their lives.

Jonathan Haidt is the author of a new book, The Anxious Generation: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental Illness. According to Haidt, the addiction to social media and gaming is damaging young psyches and causing a marked increase in mental illness and depression. What is the solution? Haidt says ban smartphones before high school.All schools should be phone-free zones, which might help re-establish unsupervised play.

The problems caused by smartphones are real, but as The Economist recently pointed out, generation after generation have been worrying about the young. In 1935, Harper’s magazine declared that mass unemployment, criminality and marijuana were, “rotting the young before our eyes.” Fifty years later, Neil Postman worried in The Disappearance of Childhood that television was the evil that was leading young people astray.

Now on to the good. Gen Z is already starting to save. How much you need to have saved for retirement is a moving target, different amounts for different individuals. An old rule of thumb from Fidelity is you need to have 10 times your salary saved by age 67. So, if you make the median income of $75,000 you need to have $750,000 saved at retirement. Others argue that you need as much as $1.5 million in savings to ensure a comfortable retirement. The retirement savings “number” is stressful since the average American, according to the Federal Reserve in 2022, has saved only $333,940.

One thing is for sure, however. The earlier you start saving the more likely you are to have a solid nest egg. Baby Boomers on average didn’t start saving until age 37 according to a study by Employee Benefit Research Institute in 2023.

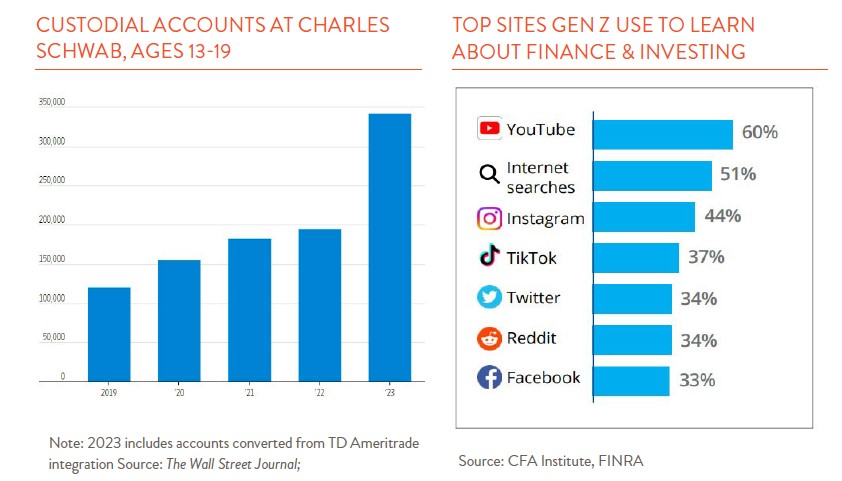

Many Gen Z’ers are getting a much earlier start. Teens generally can’t open brokerage accounts until age 18, but note how many custodial accounts parents have set up for children at Schwab recently (see above). A Bank of America survey reported that two-thirds of Gen Z investors first started learning about investing in middle school or high school versus 38% for millennials, the earlier generation. This reflects the fact that schools have finally seen the importance of teaching personal finance and also that younger people are thinking more seriously, and earlier, about their future.

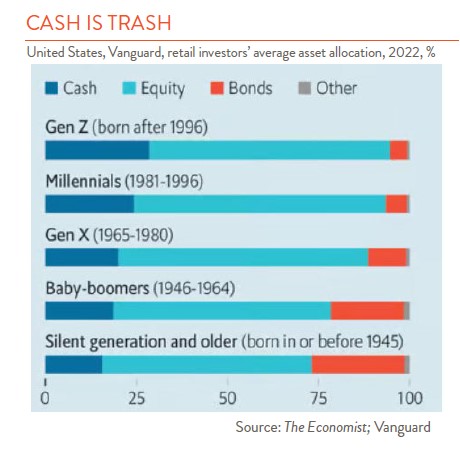

The world is uncertain and there is no guarantee that starting your savings early will lead to a stress free retirement, but a diversified investment strategy has been successful in the past, and there is no reason to think it won’t be in the future. Gen Z is heavily invested in stocks now and rightfully so (see chart to the left) . They have the longest investment time horizon. They can wait out the tough times that invariably will come. Let’s just hope that smartphones, which are causing anxiety for some, will also lead others to sensible investment information and choices.