I pay attention to final articles by departing financial columnists. These pieces always cut through the chaff and get right to the kernels of truth that the writer has learned over the years. Buttonwood is the financial column in The Economist. Buttonwood refers to the tree where trading was originally transacted on Wall Street.

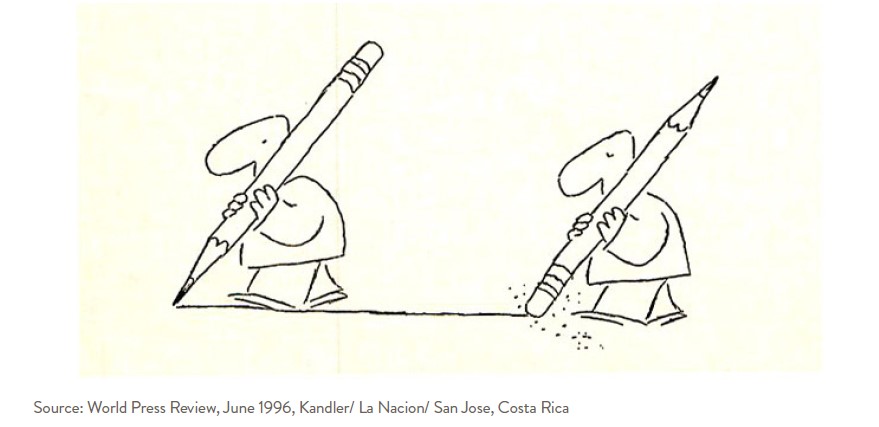

In July, the writer of Buttonwood (The Economist is one of those publications which does not identify its writers) posted her (or his?) final column. What had she learned over the years? In a nutshell, “…there is nothing new on Wall Street.” We quoted Fred Kelly, the author of The Psychology of Speculation (1930), back in our June letter, “The game is old, but the players are always new.” The rhythm of the market never changes. Wall Street is like a pendulum, swinging between hope and greed at one end and doubt and fear at the other.

And we are very “herd like.” When I started in the business back in 1972, everyone was chasing the “one decision” growth stocks, companies like Kodak, Xerox, and IBM. They were expensive but it did not matter; their growth was so predictable that even if you paid too much, you would get bailed out as the company posted much higher sales and earnings in the future.

More recently, we have had the “meme-stocks.” Remember GameStop, AMC theaters, and Robinhood? Their stock prices soared on hopes that their fortunes might improve or that another investor (a greater fool?) would come along to pay an even higher price. Get onboard now before it is too late! Well, it didn’t work.

Rakesh JhunJhunwala is known as the Warren Buffett of India. He started investing with very little in 1985, but by the time he died earlier this year he had amassed a fortune of $6 billion. He traded with some of his money, but his real secret was his steadfast faith in the long-term growth of India and the Indian stock market. He held tight through the ups and downs of the market. His patience paid off with amazing long-term results.

In 1972, when I was just out of college, the Dow Jones Average finally climbed above 1000. Little did I know it would be another 10 years before the market would cross 1000 and never look back. We had a painful decade of stagflation, sky-high interest rates, raging inflation, and little growth. But persistence and faith in the U.S. market paid off. Today, even with a possible recession looming and the market off for the year, the Dow is still over 32000. Big gains for the long-term investor. So be like Mr. Jhunjhunwala – stay the course.