It’s been more than four years since the World Health Organization declared Covid-19 a global pandemic on March 11, 2020. Covid is still very much with us — in fact, there’s a surge in infections now, as there has been every summer since 2020. But we’ve come a long way from the dark pre-vaccine days when Covid was more life-threatening. Covid still can be a serious illness, and sometimes fatal; but for many today, Covid has been reduced to the nuisance of feeling unwell for a short period.

Over 2020-2021, we and many others tried predicting how things would look once we emerged from the worst. It was simply too enthralling to imagine a wholly different world – and really, what else was there to do during lockdown?

Would the handshake come back? (It did.) Would leisure travel recover? (Yes, with a vengeance.) How would the office and the world of work change? (We’re still figuring this out.) In this newsletter, we questioned if universities and senior living communities would ever get back to normal. We guessed that shopping at bricks-and-mortar stores would eventually recover but also thought telemedicine would develop more than it has. We worried about everyone’s mental health, especially students in high school and college. And while we never went in this direction, others guessed we would go into a “Roaring Twenties” era of carefree pleasure-seeking, as after the 1918-1920 Spanish flu.

Many widely anticipated “big picture” socioeconomic trends did come to pass as expected. There were serious efforts to build supply chain resiliency, which meant more onshoring and reshoring. The age of small government gave way to big government spending. And we did see changes in one area we were extremely interested in: the balance of power between labor and corporations. In the late pre-pandemic years, there was much ado about wage stagnation while corporate profit margins continued soaring – a situation that just did not seem sustainable. The pandemic offered a chance for a major reset for workers, as we and many others expected.

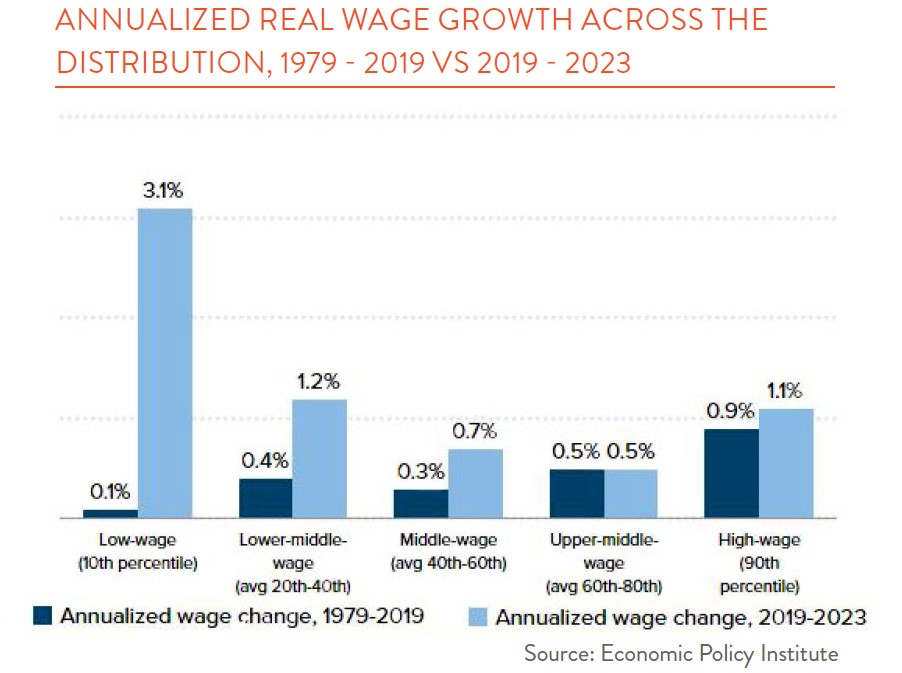

While inflation reached unanticipated levels, real wages (meaning after inflation) rose more over the 2019 -2023 period than the previous four decades – especially for low-wage workers. Yet the state of the U.S. worker is ever evolving. In a short time, we’ve cycled through a “great resignation,” worker shortages, high job vacancies, “quiet quitting,” and just recently, the first inklings that the job market might be starting to weaken.

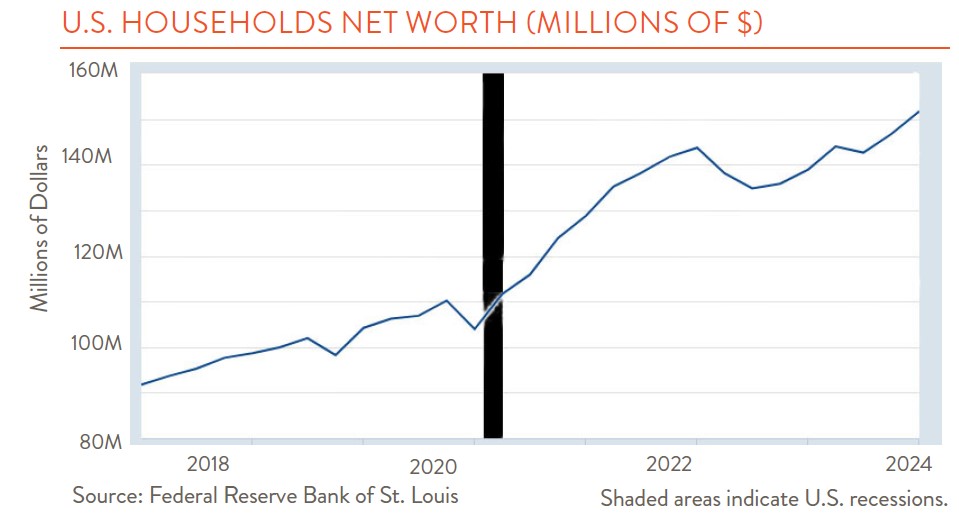

One of the biggest post-pandemic surprises for us has been how much U.S. household wealth has grown. This is not to discount persistent wealth inequality or the hardships that many have endured. But, according to the Fed, household wealth has grown across the board and markedly so for low-wealth groups. The San Francisco Fed found that post-pandemic wealth accumulation was greater than what would have been expected without the shock of the pandemic.

So, what happened? Sitting in the depths of economic collapse in 2020, we never would have imagined that so many Americans would end up experiencing so much prosperity. Yet somehow, through a combination of heavy saving during the lockdown, generous fiscal stimulus, zero interest rates, wage gains, debt repayment suspensions, and a booming stock and housing market, many Americans became wealthier than ever. Today, an all-time high of 30% of the U.S. population has a stock market portfolio worth at least $500,000. A record-high 37% of the population has a home worth more than $500,000. Wow. How little we knew when Covid first hit us. How little we still know today.