Over the past decade, a diversified portfolio of U.S. stocks has returned about twice as much as an equivalent portfolio of international stocks. That’s an exceptionally long period of exceptional U.S. outperformance — an absolute trouncing. But like many others, we wonder how much longer this can go on.

There are legitimate reasons for the superior U.S. returns of the last decade. The U.S. has long had structural advantages that others don’t, like deep capital markets, technology leadership, and entrepreneurial dynamism (see page 1 for more on this). In addition, the last decade has been one of U.S. dollar strength, and the roughly 30% appreciation in the dollar certainly has helped U.S. investors.

More important, U.S. corporate fundamentals have simply been better. The chart to the right shows that the U.S. has far outpaced the rest of the world in earnings growth for more than a decade. Since 2010, U.S. companies also have generated higher return on invested capital (ROIC) than international peers in all sectors save energy and healthcare, and absolutely crushed it in technology.

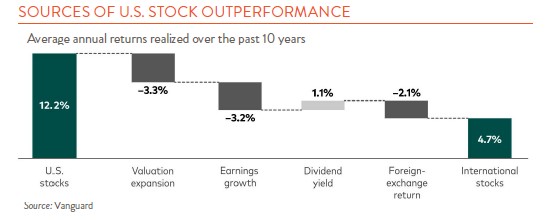

But there’s another reason for U.S. stock outperformance that might be more worrying: valuation expansion, or U.S. stocks becoming more expensive as their popularity increases. The chart below breaks out the different sources of U.S. outperformance over the last 10 years: the strong dollar contributed 2.1 percentage points of outperformance. Better fundamentals in the form of higher earnings growth contributed 3.2 percentage points. But valuation expansion contributed the most, or 3.3 percentage points.

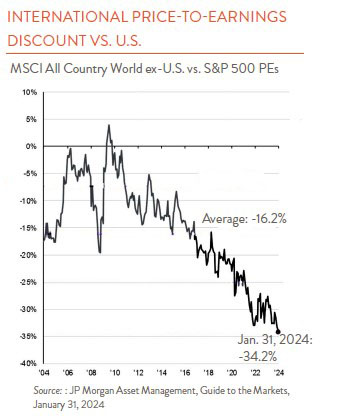

In other words, U.S. valuations look stretched, even considering the better fundamentals. The chart on the bottom shows that price-earnings multiples for international stocks relative to U.S. stocks are more discounted than any time over the past two decades. Can it really make sense that the Magnificent Seven (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) are worth more than all of western Europe’s listed stocks together?

We have no special reason to bet against the U.S. or to believe it will falter. As Warren Buffett once wrote, it’s been a terrible mistake to bet against America – and we agree. But sticking only with the U.S. and avoiding international stocks is a pretty bold bet on the status quo. According to BlackRock, international markets have outperformed the U.S. in 40% of all 10-year rolling periods over the past 50 years.

Buffett himself has been looking abroad to Japan, which actually has been outperforming the U.S. in local currency (yen) terms thanks to attractive valuations and improved earnings growth. In fact, if you remove the effect of the strong dollar and look at local currency returns, several other markets around the world have outperformed the U.S. the last three years, including Denmark, France, Italy, Norway, Spain, the UK, and Australia.