Corporate profits still are rising, and that’s good news in a world with plenty to worry about. War, inflation, political divisiveness, take your pick — you’d be forgiven for thinking things are going to hell in a handbasket. But at least for now, corporate sales and earnings are staying resilient.

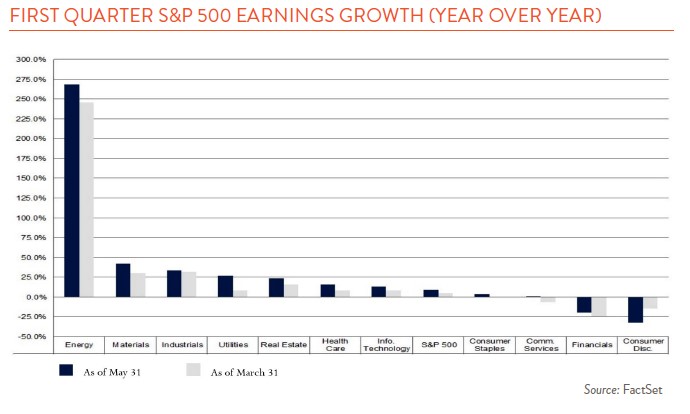

According to FactSet, 77% of the companies in the S&P 500 reported first-quarter earnings per share (EPS) that beat expectations, and 73% reported positive revenue surprises. Yes, there were some big “misses” that generated big headlines — but there always are. The bottom line is that earnings still are growing across multiple sectors, and energy earnings have absolutely soared (see chart below).

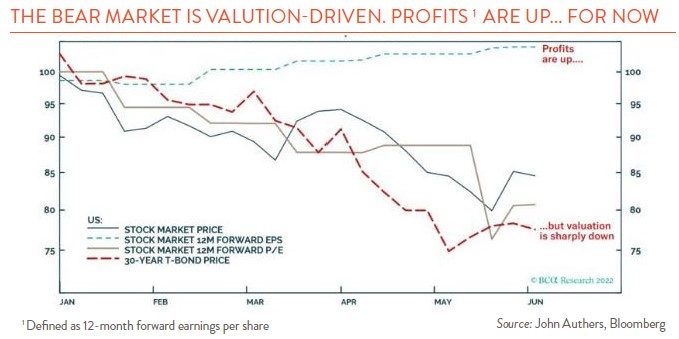

The reason stocks have done so terribly this year isn’t faltering profitability. Stock prices are driven by both earnings and the multiple investors are willing to pay for those earnings — the price/earnings (P/E) ratio or “valuation.” And as John Authers of Bloomberg points out in his chart below, this year’s painful stock selloff has been driven entirely by valuation. “Despite everything,” he writes, “companies are pulling in as much revenue as ever and earning a slightly higher margin on it in profit.”

Of course, what really matters for stocks is not what has happened up to now, but what lies ahead, and that is why investors are reassessing what they’re willing to pay. Interest rates are rising, and higher rates make it harder to generate profits while also pushing down the value of future earnings. In addition, forward guidance – the earnings projections provided by companies for future periods – hasn’t been fantastic. Not all companies provide forward guidance, but of the 101 that have, 70 issued negative guidance, while 31 have issued positive. Forward guidance is not the be-all or end-all to hang your decision-making on. But it indicates caution – and perhaps inflection.

We listen to dozens of company earnings calls every quarter, and this time, macroeconomic headwinds got much more airtime.

Last year, demand was not an issue. The focus was on supply chain constraints and the challenge of securing inputs and parts – and finding the shipping containers and trucks to deliver product. While this remains an issue today, there’s been a shift to also questioning if demand is holding up. Companies that missed sales expectations were probed on whether the problem was supply chain-driven or demand-driven. For companies steaming ahead in full-growth mode, including cloud technology and software companies, the question was, what makes management so confident that demand is so resilient? If demand falters, how much flexibility do they have to lower costs and slow down hiring?

Challenges lie ahead. Inflationary pressure on both inputs and wages continues to be a concern across the board. Both the power to pass on price increases to customers and the ability to hire and retain workers are getting highlighted as important competitive advantages. And finally, for some companies, the strong dollar is becoming a bigger headwind than expected.