Not sure exactly who said this, but they were talking about making predictions. It’s just a fool’s errand to try to look too precisely into the future. Unfortunately, this is what we all must do when dealing with our investments.

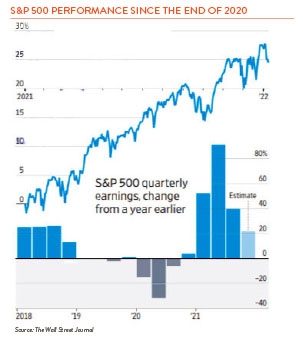

COVID has been a real disruptor to everyone’s daily lives but surprisingly not a big disruptor to the stock market averages. The S&P 500 registered a total return of 31.5% in 2019, 18.4% in 2020 and 28.7% this past year. Will our luck run out in 2022? We have already had three great years of gains, valuations are stretched, inflation is heating up, the Fed is about to increase rates, and who knows how bad Omicron, or “Son of Omicron” will get? So, stocks may fall.

On the other hand, consumers are still flush with cash, many investors are sitting on big stock market gains, corporate profits are expected to be up 10%, and wages are rising. So, the market upswing could continue.

Where do we stand? Our crystal ball is too cloudy to know all the answers here. We think it is better to control what we can, not predict what we can’t. And what can we control? Jason Zweig recently noted in The Wall Street Journal that there are two things we can control — our habits and our discipline. We can choose an investment strategy that makes the most sense for our age and our risk tolerance, invest in a balance of riskier stocks and less risky bonds, and then – just do nothing. Go sit quietly in your room and exercise extreme sloth. Set it and forget it works.