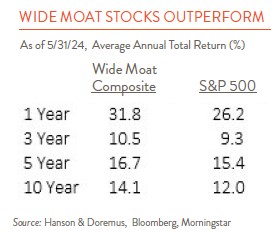

In last month’s issue, we examined the concept of economic “moats” and how we use them to help identify and value potential portfolio investments. While the term is not new, its popularity has grown over the years. Investors’ love affair with companies possessing wide moats, or durable competitive advantages, comes as no surprise given results in the table to the left. Morningstar’s Wide Moat Index has outperformed the S&P 500 index over the past 1-, 3-, 5- and 10-year periods.

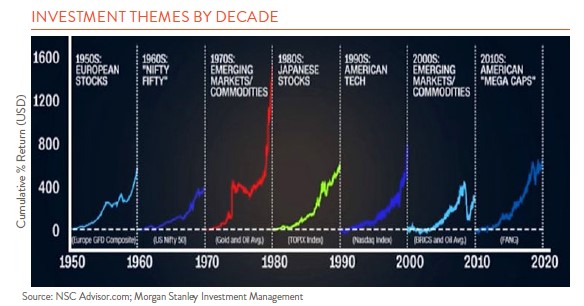

With over 35 years of investing experience under my belt, I am left wondering, is the focus on wide moats today just another investment fad? The chart below, identifies the investment themes that dominated each of the past seven decades. Speculative behavior certainly fueled the outsized gains in each period, but other more fundamental factors also played an important role. Here are a few of them.

The Economy Matters: Over long periods of time, stock prices move in lock step with corporate profits. Given this dynamic, it comes as no surprise that strong economic forces were at work during several of the decades. In the 1950s, an influx of corporate and government funds into post-recovery Europe benefited firms across the region. In the 1960s, an emerging consumer class (i.e., Baby Boomers) fueled gains in the Nifty-Fifty, a group of stocks dominated by firms like Polaroid, McDonalds, and Disney. Economic policies aimed at boosting industrial production and export trade contributed to Japan’s “economic miracle” in the 1980s.

Commodity Booms (and Busts) Happen: Commodity price cycles have historically had a big impact on emerging market stock performance. This was especially true in the 1970s when spiking energy prices fueled gains in the shares of oil and gold exporters. While most emerging market economies have diversified and matured since then, strong commodity price rallies again featured in the more recent (2000-2010) period of outperformance.

Keep an eye on Technology: Both the 1990s and the 2010s were periods dominated by technological innovation. The promise of all things connected to the World Wide Web led to the surge and subsequent bust of tech stocks during the 1990s. While a whole range of tech stocks did not survive the period, many firms from the era, such as Cisco and Amazon, remain vibrant today. The adoption of a range of technologies in the 2010-2020 period led to the FAANG tech stock surge.

What stocks or themes are likely to dominate going forward? It would be easy to assume that the 2020s will go down as the “Artificial Intelligence” decade. But despite their strong outperformance over the past year, I have doubts. As a technology, AI holds great promise and yes, not a few risks. But historically, the process of figuring out how to make money off a new technology takes time.

Because of their durable competitive advantages, I continue to think that wide moats stocks will produce above market returns over the long term. But I doubt the group, as a whole, will generate the eye-popping returns witnessed in “theme” stocks of earlier decades. For one, the wide moat concept lacks the simple and appealing narrative typically found in earlier thematic investments. Second, wide moat stocks are a large and diverse group. Morningstar’s index, which makes up approximately 65% of the S&P 500’s market capitalization, includes 157 holdings from many market sectors. This broad diversity suggests that any rally in the shares would also be largely reflected in broad market indices like the S&P 500, limiting outperformance.

Whatever comes next, this look-back in history has revealed a few things. First, assuming that last decade’s winners will dominate in the next cycle has not proven to be a profitable strategy. Second, predicting which sector or asset class will dominate next is extremely difficult. Our approach of trying to pay reasonable prices for firms that possess durable competitive advantages across market cycles helps protect us from both of these market truths.