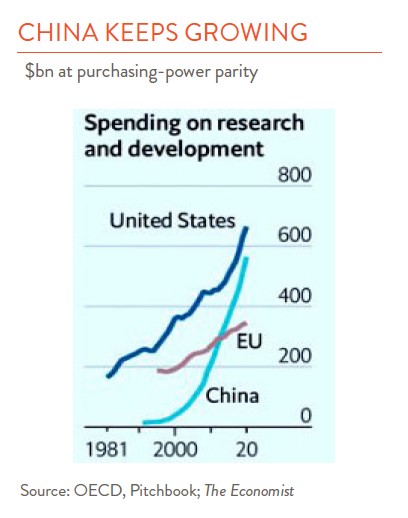

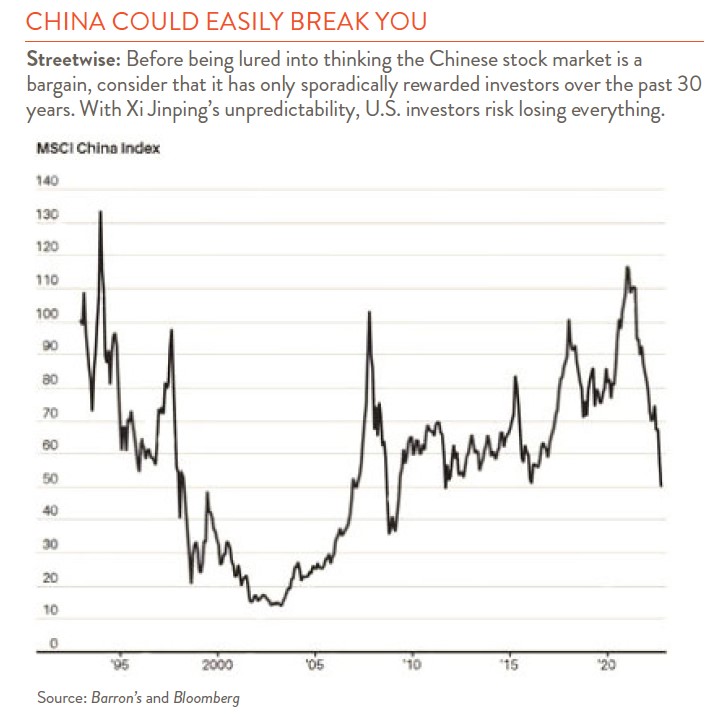

This is the question Barron’s posed recently (10/30/2022). Over the years, China has been a frustrating puzzle not only for foreign governments but also for investors. Look at the growth of the country since 1981 (chart right). How could such rapid growth not translate into great returns for investors? Well, growth has not equaled investment profits. The MSCI China Index, which includes 85% of Chinese equities traded in China, Hong Kong, and on foreign markets, has made no real progress since 1990. Some investors and mutual funds have produced positive investment returns but nothing like the growth in GDP.

As usual there are opposing sides to this story. The positive take is, eventually China will mature and be a solid place to invest. China is the world’s #1 manufacturer. It accounts for 20% of our total imports. It has developed world class alternatives to Visa and Mastercard with Alipay and Tencent Pay. Consumer income has grown dramatically, and China is the leading buyer of high-end status goods. So just bide your time, say the Bulls.

And while you are waiting, just remember how cheap Chinese equities are. Price-to-earnings ratios today are lower than at any time the past decade.

But the Bears say this is all hopes and dreams. China has shifted dramatically under Xi Jinping and this will continue to with his reappointment to another five-year term (and possibly reappointment for life). The newly configured Standing Committee of the Politburo, all Xi loyalists, is not likely to shift towards favoring private business and investors. Xi has chosen ideology over economics. He sees the private sector as a threat to the Communist Party, and without the Communist Party, there is no way of holding the country together. Just look at the chaos in Russia after the fall of Communism, he cautions.

Xi today is reemphasizing state-controlled businesses over the private sector, internal security over personal freedoms, and top-down directives over letting markets decide. The old political bargain, that we will let you do whatever you want to make money as long as you do not challenge the authority of the Communist Party has changed. Now the deal is, do not challenge the Communist Party and oh by the way, we will also make the rules for the economy.

We admit we have been guilty in the past of being overly bullish on China. It is such a large and growing market. We are now more skeptical but, like in a fancy restaurant, we are still tempted to at least look at the dessert menu. The Chinese have a saying, “The mountains are high, and the Emperor is far away.” There are some sectors of the economy and market that are under the radar and less likely to be targets of government crackdown. One example might be Yum China, the operator of KFC and Pizza Hut restaurants in China. Profitable, and also quiet.

The biggest immediate problem for China is its zero-Covid policy. The economy will be stop and go until zero-Covid is resolved. The government is now making noises about loosening its pandemic policy. Any real change here will be a big positive for the stock market. But we recommend, “Trust but Verify.” Wait to see results, don’t anticipate changes. Investors have been burned before.