We are talking about saving for retirement. Back in the days of Defined Benefit Plans if you worked for a company for 25 or 30 years you were guaranteed a retirement payment of as much as half your ending salary, for life. When you combined this with Social Security, you were all set. Sadly, those days are gone.

Today everyone, especially younger people, must worry about their own retirement. If you wait until age 40 to begin serious saving you have a lot of catching up to do. We were reminded of this by a recent piece in The Wall Street Journal by Glenn Ruffenbach titled, “Young Adults, How to Start Building a Nest Egg for the Future.”

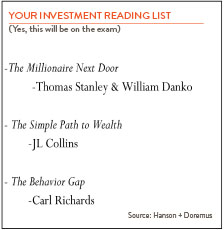

Five years ago, I was approached by the University of Vermont Grossman School of Business to initiate a new course titled Personal Finance and Investing. Nothing like this had ever been offered through the Business School, or at most universities for that matter. Art Wright, a partner in our office, and I have taught the course each semester since. It has consistently attracted the maximum 65 students per semester. Many students told us they previously had little knowledge of how saving or banking or credit cards or mortgages or car insurance worked. Other students told us, “My parents told me I had to take this course.”

Jonathan Clements was the Personal Finance columnist for The Wall Street Journal back in the 1990s. He once told me that there are only about 25 different topics involved in personal finance. The challenge after writing all 25 was to convince your editor that your next article was different! Clements is right that there are not that many different angles to personal finance but putting them into practice is the difficult thing.

We list here our condensed personal finance advice for younger people. The problem, as Pogo once said is, “we have met the enemy and he is us.” Try spending less than you earn, try salting away a reserve fund, and try investing (preferably in a 401(k) or IRA) 15% of your earnings. It’s difficult. It requires a ton of restraint and discipline. We are not good with the mantra, “I will save today so I will have more to spend 30 or 40 years from now.” “One-click Amazon” is just too tempting. But saving is what we must do.

Once you start saving, then investing is the next test. The stock market will always do what it has to to shake you out at market bottoms and get you wildly excited at market tops. Keeping your head while everyone around you is losing theirs is one of the biggest tests for investors. There will be sharp drops along the way, but if you stay the course, you will almost certainly come out ahead. Younger people should have most of their money in stocks. They have decades to recover from even the most severe drops. Closer to retirement consider blending in a higher percentage of stable assets like bonds. So, there you have it, our simple rules. Now it is up to you to do the hard part!