This line is from a New Yorker cartoon dating back decades. We all want to know what is going to happen in the future but it’s a slippery slope. The temptation is there to forecast but the results are often random at best. As Wilmot Kidd, a very successful long-term portfolio manager, recently said in The Wall Street Journal, “Skill is just recognizing when you’ve gotten lucky.”

But investing is all about the future, so we must make some educated guesses no matter how uncertain the future looks. In five years, what sector is most likely to have higher sales, higher earnings, and higher stock prices? Some sectors have very little control over their destiny. I am thinking of the steels, the autos, and the oils. The economic cycle will influence their results and who knows what the economy will look like in 2026?

Technology is a growth industry and companies here can grow and prosper irrespective of the overall economy, but many technologies, and individual companies, can be new today but gone tomorrow. Remember Motorola and Nokia cellphones, the Segway, and the Blackberry? We invest in technology, but we are sensitive to price and wary of overhyped stories.

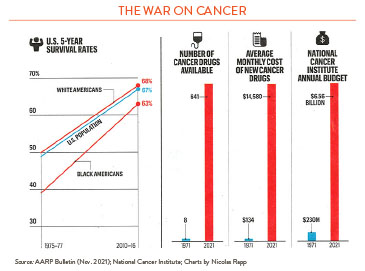

A sector which we think combines growth with predictability is healthcare. We are all getting older and will need more drugs, more medical devices, and more services. The charts here show the technological progress in one area of the industry: drugs. Since 1971, the cancer death rate is down more than 25 percent due in part to the dramatic increase in new drugs. Cancer is still the number one killer of those between ages 60 and 80, so new treatments will continue to be important.

The speed of new breakthroughs is increasing dramatically. Look at the new COVID-19 vaccines. It took less than one year between the detection of COVID-19 and the first shots in the arm. Historically, vaccines using the traditional fermentation process took 10 years or more to develop. The new mRNA technology instructs cells within the body to manufacture the “spike” protein found in coronavirus to prime your immune system to fend off the virus. BioNTech, one of the companies pioneering this technology, predicts that within 15 years one-third of all new drugs will be based on mRNA technology, speeding up considerably the treatment of diseases like malaria, TB, HIV, and cancer.

The healthcare sector is not one homogenous industry but a series of product silos. In general, the companies making devices like minimally invasive surgical instruments, heart implant products and drug delivery systems have done very well. Insurance companies offering HMOs have also been successful.

Much less profitable for investors have been for-profit hospitals and surprisingly, Big Pharma, which is responsible for many of the drugs we are talking about here. These companies have in general underperformed the market the past five years. Hospitals have suffered from staffing issues, cost increases, and insurance reimbursement rates. The fear of government price controls is a big reason Big Pharma has not done better.

The developed world is getting older and developing countries are getting wealthier. Demand for healthcare is ever increasing. We are looking closely at the whole sector for profitable investment candidates. But every coin has two sides. Anne raises some caution flags on page 3.