January is a good month to talk about personal finance. Many people are looking to turn over a new leaf and get motivated about finances. But on January 1, Intuit, which owns a popular free budgeting app, Mint, decided to close the service.

Warren Buffett likes to say about investment, “it’s simple, but not easy.” The same goes for personal finance. It’s not that complicated. There are only a few things to keep in mind, but the execution can be really tough. If you simply live within your means, spend less than you earn, save early and often (15% of your income is a good target), establish a diversified long-term portfolio of stocks and bonds, and resist the temptation to trade or panic during tough times – you are going to end up a rich person.

But as they say, there is often slip between cup and lip. Those people using Mint to track their spending in order to establish a good saving discipline are now being forced to find a replacement app they are comfortable with. Before you jump at other apps, however, you might want to consider an alternative.

I have always found computer budgeting complicated. Try the “pay yourself first” approach. With this strategy, you save what you need at the beginning of the month and then shoehorn your expenses into what is left. It takes less time and is simpler than budgeting apps. To uncover expenses you can cut, try also paying all your daily expenses in cash for a month. You will be surprised how many expenses you can live without.

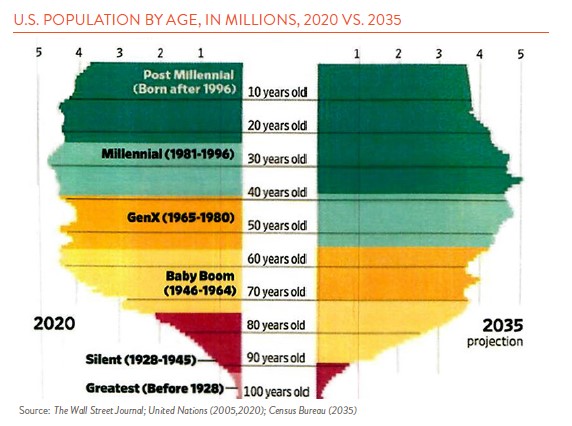

Budgeting is just one part of personal finance. Here are some other issues to be aware of. For young people (the fastest growing demographic) it is important to start saving as early as possible. I realize paychecks are slim today but even so, producing small amounts of monthly savings is important.

Compounding means earning interest on interest, and as Albert Einstein said, it is the eighth wonder of the world. Say at age 25 you start saving $500 a year and earn 7% compounded annually over the next 40 years. Your savings will grow to over $107,000 by age 65. If you waited until 45 to invest the same $500 a year compounded at 7%, your savings would grow to only $22,000. This doesn’t mean you shouldn’t save at age 45, but it does mean it is important to start early to let compounding have its greatest effect.

Once you are invested in a diversified portfolio of stocks and bonds, be careful of your emotions. In 2022, both safer investments (bonds) and riskier ones (stocks) lost money. Many investors sold and moved to cash, assuming 2023 would be a recession year and markets would do even worse. In fact, this past year the S&P 500 increased 26.3% and bonds gained on average 5.5%. Don’t try market timing; it will just ruin your long-term results.

A final cautionary note is for older savers. Sumit Agarwal, a professor of finance at the National University of Singapore and the author of a Brookings Institution paper on personal financial decision making, notes that in studies in both the U.S. and Australia a typical 50-year-old underestimates his life expectancy by anywhere from five to ten years. One of the biggest risks in personal finance is that you will outlive your savings. None of us know how long we will live. Some will live longer, and some will die early, but when doing your financial planning, take the long view, save early, and invest for longevity!