Wall Street has a long history of coming up with “innovations.” Some new products such as Exchange Traded Funds (ETFs) have truly benefitted investors. But for every one of these good ideas there have been many more that did investors harm; the collateralized debt obligations (CDOs) that played such a central role in the 2008-2009 Financial Crisis are the poster child here.

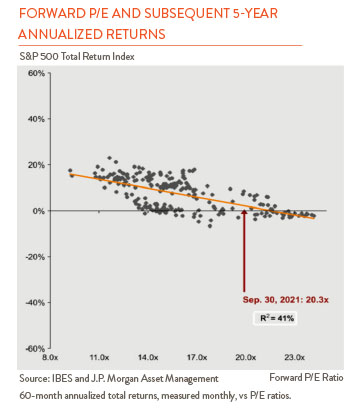

Several trends today are encouraging banks to, once again, fire up their product innovation teams. First, investors are feeling flush. According to the J.P. Morgan Institute, the median household’s checking account held 50% more this past July than in 2019. Consumer balance sheets too are in excellent shape thanks to rising real estate and retirement fund balances. Second, the outlook for future returns from traditional asset classes like stocks and bonds doesn’t look great. On the stock side, the broad market recovery of the past 19 months has left shares trading at lofty valuations. Historically, high valuations (P/E ratios) suggest lower future returns (see chart right). On the bond side, a recovering economy and uptick in inflation is prompting the Fed to reduce its bond buying and consider raising rates in the years ahead – both actions that are bearish for bond prices. Finally, new technologies such as blockchain are expanding the way financial professionals think about packaging risk and return.

The “holy grail” in the investment world today is finding an asset class or product that offers the prospect of strong returns and diversification benefits (i.e., their returns do not move in sync with stocks or bonds). The products listed below are just two of the latest efforts to achieve these goals.

Bitcoin: While Bitcoin has been around for years, the first cryptocurrency ETF was just released late last month. Prior to its release, investors needed to go through a somewhat cumbersome process of setting up and funding a separate account or “wallet” to hold their Bitcoin. The new ETF avoids this step by buying Bitcoin futures rather than the cryptocurrency itself. This approach has proven popular with investors attracting $1.3 billion in assets in the first two weeks since its launch. As is always the case in investing, however, it pays to “look under the hood” before buying this product. A lack of liquidity in the Bitcoin futures market could make the already volatile asset class even more difficult to sell and the annual expense ratio stands at a lofty 0.95%. My take? While Bitcoin may offer diversification and return benefits over time, I would pass on this new product given its limited trading history, the illiquidity of its underlying market, and high expense ratio.

Non-Fungible Tokens (NFTs): While not exactly a creation of Wall Street, this “asset” is attracting a lot of dollars. Trading volume in the third quarter totaled $10.67 billion, up over 700% from the second. The token here can be anything digital (tweets, music etc.) but to date, most NFTs have involved some form of digital art. “Non-fungible” means that unlike dollar bills which are fully interchangeable, your holding is unique. NFTs utilize the same blockchain technology that cryptocurrency Ethereum is based on to track ownership. As with art, nothing is to prevent someone from copying your NFT but owning the original is what has value. Like most art, the monetary value of an NFT is based not on its underlying earnings potential but rather the hope that someone else will pay you more for it in the future. For this reason, I would classify this asset class (if it is one) as speculative at best. NFTs, considered a fad by many, are just in their infancy. Some investors consider them an alternative store of value while a range of companies are incorporating them into their marketing campaigns. I would give this product a pass as well until the ultimate “use-case” becomes clear.