For most of the past decade, we didn’t spend a lot of time thinking about how to invest our clients’ cash. With short-term interest rates pegged near zero, it didn’t really matter whether your “ready” funds were in a bank deposit account, money market fund, CD, or short-term Treasury bill. Income on cash-like instruments of any sort was simply not to be had.

The Fed’s efforts to fight inflation by raising rates has rocked the investment markets this year. As Liz points out on page 3, this sea change has been particularly painful for bond holders who had enjoyed decades of falling yields and rising prices. Stock investors too have felt the pain as interest rates weigh on corporate profits and valuations.

But there is another side to the rising rate story. While long ignored, cash and “near-cash” returns are beginning to perk up. True, the yields are still relatively low, but the dollar volumes are huge. WSJ columnist Jason Zweig recently reported that banks today hold $18.5 trillion in deposits and another $4.5 trillion in money market funds. Investors, concerned about the eroding effect of inflation, are moving their cash into higher yielding alternatives, and the institutions who manage these funds are bracing for more of this cash “sorting” in the coming months.

What are investors’ options for all these uninvested funds? As always, having a clear goal is the first step to any successful investment plan. If absolute safety and liquidity (i.e., being able to write checks, for example) is paramount, then traditional checking or savings accounts are still your best choice. Most products here still offer little, if any, interest with the national average annualized rate around 0.10%. Shopping on sites like Bankrate.com can reveal rates as high as 0.70% although these products typically come with restrictions.

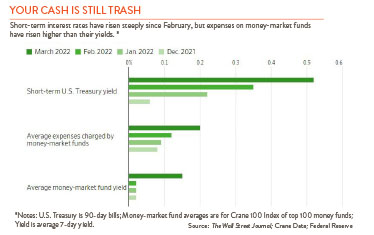

For those who still want safety but are willing to have less liquidity, purchased money market funds may meet your needs. The annualized 7-day yield on the Crane Index of the 100 largest money market funds averaged 0.34% as of last week, up from a rock bottom low of 0.02% at the end of February. These funds’ yields should be even higher given the 0.75% increase in the benchmark fed funds rate over the same period but for a little-known feature relating to fees. Traditionally, money fund managers charge anywhere from 0.25%-0.50% to manage short-term investments. However, as rates on cash fell below these levels over the last decade, most managers waived their fees to avoid offering clients negative yields. Now, rising rates are allowing managers to reinstate their fees (see chart below). Once fees are normalized, rates on money funds should move more in line with short-term rates.

FDIC insured CDs and short-term Treasury bills (3-month) are a good option for investors still looking for absolute safety but willing to accept even less liquidity. Rates on both instruments are now up over 0.70% since the start of the year. Extending the maturity can provide additional yield with 1-year Treasury rates now at 1.97% and 1 year CDs exceeding 2.00%.

Finally, short-term bond and floating rate funds lie at the other end of the risk/reward spectrum for short-term investors. While there are lots of choices in these categories, investors are generally assuming more risk tied to interest rate changes. If the average term of the fund’s holdings is very short, the risk of loss is limited — but it is a risk, nonetheless. The short-term Treasury bond fund category, for example, has lost 4% since January 1st in the face of rising rates. As is always the case, investors can pick up yield by investing in funds that hold lower quality investments such as corporate debt or bank loans. These funds today can yield anywhere between 1.30% and 3.80%.

While short-term yields may not get anyone too excited today, getting any return on an investment that promises to hold its value is a new experience and one that may look increasingly attractive in today’s volatile markets.