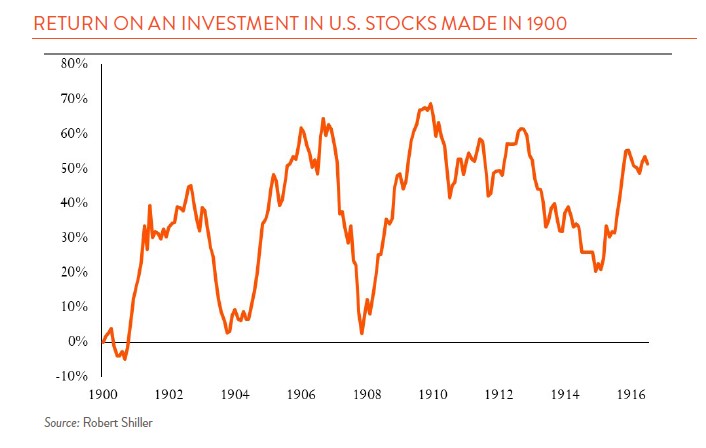

We think the world is a wild place to be an investor right now. What about during the turn of the 20th century? Back then, panics and crashes were a feature of the market, occurring in 1873, 1884, 1893, 1896, 1901, 1907, and 1914. The average loss in U.S. stock market value during those times was around 27%. And through it all, an investor called Hetty Green thrived.

Born in 1834, in an age when women were discouraged – if not outright barred – from financial independence and participation, Hetty Green defied convention and became a financial icon. She may not be a household name today, but she took a Massachusetts whaling fortune, and at a time when many others were losing theirs, multiplied hers. She died with the equivalent of billions in today’s dollars and had enough on hand over her lifetime to bail out individuals and institutions – including some banks – during these panics.

Hetty is oft-maligned as the “Witch of Wall Street” and remembered as a scold and a miser – but we all know how history can be unkind to the legacy of successful women. She was also a Quaker who quietly helped many in need. She got her start at a young age reading financial newspapers to her grandfather, and became so adroit with numbers that her father eventually entrusted her to run the family’s affairs.

What followed were decades of profitable involvement in global financial markets on the back of her rare abilities to not lose her nerve and see opportunity throughout the many panics of the day. So what made her so successful during times when many others were losing their cool? She kept to a few main principles.

- Avoid speculation

Despite her immense wealth, Hetty avoided overly complex investments. She invested in what she understood: government bonds, railroads (the solvent ones), and real estate. She did not pursue exotic strategies or speculative ventures, and her discipline kept her from chasing the manias of her time. She had an eye for what was too good to be true, and importantly, was nearly immune to the common fault of keeping up with the Joneses (or Pierponts). While her contemporaries were salivating over high-yielding railroad bonds, Hetty studied what was underneath those investments and avoided the many shady ones.

- Avoid debt

Green’s personal frugality became legendary – almost to the point of caricature. She wore the same style of black dress for years, traveled with her important papers in a satchel, and was known to seek free medical care to avoid paying for a doctor. But beyond living below her means, she also learned early on how ruinous debt can be. She avoided buying on margin and the use of leverage in investing. Without the burden of debt, Hetty was much less exposed to the frequent downturns of her time. During the Panic of 1907, she lent over $5 million to New York City to see it through crisis – she could do that because she did not owe tremendous sums herself!

- Think long term and buy when others are selling

Avoiding speculation and debt allowed Hetty to understand financial panic as a potential buying opportunity. She did not retreat from panics, but kept a cool head and often stepped in as a lender of last resort, as described earlier in the case of New York. In these situations, she often bought assets at distressed prices. Success in this way was not due to market timing, but to discipline and conviction. She also distrusted the media and market sentiment and made her own decisions, often against the grain. She was a contrarian value investor before those two words were ever put together.

Hetty Green died in 1916, and we aren’t writing about her just because she played her market environment well and made a fortune – though the fact that she was able to do this at all as a woman during her time is astounding. Rather, the lesson of Hetty Green is that she stuck to timeless principles that saw her through multiple financial crises. In today’s noisy, fast-changing financial world, her story is a reminder that the real keys to success haven’t changed. It may not have been flashy, but it worked.