Morningstar.com recently published an article, “12 Lessons the Market Taught Investors in 2023,” that explores some of the big picture teachings from an interesting year. Here are a couple themes we want to highlight.

The first is that it’s really hard to predict what is going to happen and how those events will impact financial markets—especially when our political biases predispose us to a certain view.

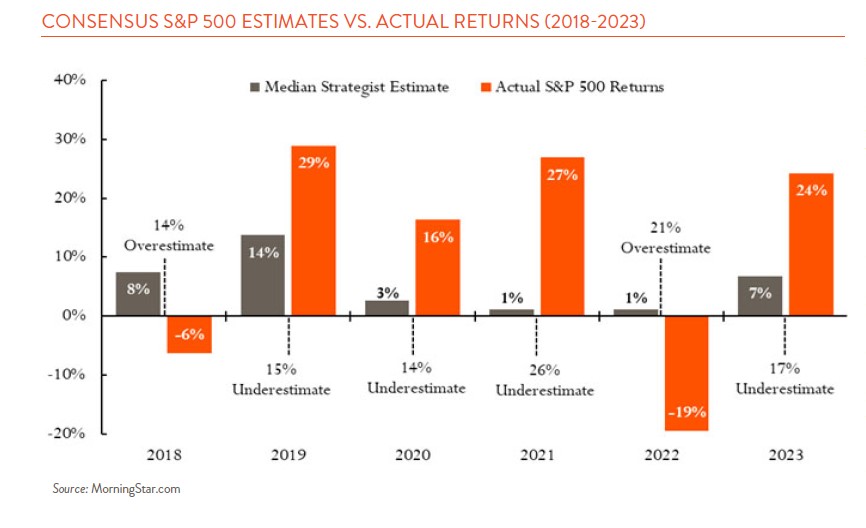

Short-term market forecasts often rely on a singular narrative to explain overall stock market performance. But markets are complex. Multiple variables will drive the market over a 12-month period, many of which would be hard to imagine, like the pandemic in 2020. As shown in the chart below, investors should be wary about making investment decisions based on the flood of market estimates made at the start of every year.

Even with perfect knowledge of the year’s major events ahead of time, it’s difficult to gauge the impact on the market. In 2020, we experienced a major pandemic and lockdown along with a contentious U.S. presidential election. With that knowledge, one might have predicted a substantial decline in stocks, and the S&P 500 index did see a one-month decline of 24%. But then the index closed 2020 up 16%! The 26% growth in 2023 would also have come as a surprise given knowledge of geopolitical events in Europe and the Middle East, U.S. bank failures, and the property market collapse in China.

Perfect foresight on events does not necessarily mean prescient market forecasts. This also applies to the impact political outcomes might have on portfolio returns. Fears about the opposing party winning a presidential election can lead investors to sell or underinvest. This has happened on both sides of the aisle over the last 20 years, causing investors to miss out on years of strong performance because of their political views—certainly something to keep in mind for 2024.

The second big theme is that market timing is difficult, if not impossible. The inability to make accurate short-term market predictions also supports our belief that investors should remain invested in the market. Some of the most popular market valuation metrics (for example, price-to-earnings ratios) have been well above their long-term average over the last three years, leading observers to predict market downturns every year. While this advice worked in 2022, the market avoiders lost out on strong growth in 2021 and 2023.

Relatedly, it can be disastrous in the long run for investors to let bouts of poor performance drive them away from risky assets in favor of safe havens. Over the past century, the annualized return of the risky S&P 500 was 6% to 7% above risk-free Treasury bills. For $100 invested in 1928, the S&P would have returned $787,019 by 2023 versus $2,249 for T-bills. But performance is not distributed evenly within a decade or a year; it happens in spurts. Despite the long-run dominance of the S&P 500, Treasury bills actually outperformed during three extended periods of more than a decade each (1929-43, 1966-82, and 2000-12). Indeed, in over 90% of months stocks effectively provided zero return on average. It was just 97 of the century’s worth of months that drove all the return. Jumping ship when things look bad means you might not be invested during the one month or year that drives performance.

Our main takeaway from the article is that staying true to your investment plan is likely the best method for long-term capital appreciation for most investors. This includes remaining fully invested across asset classes and focusing on the long term.