In 2015 Xi Jinping announced the “Made in China 2025” initiative. The objective was to move China away from laborintensive, lower-wage industries to more technology-focused ones.

The Chinese identified 10 priority sectors where it wanted to compete, and dominate. These included semiconductors, aerospace, biotech, AI, robotics, and electric vehicles. Achieving success would mean faster GDP growth and freedom from Western tech company domination.

China over the years has tried to compete in internal combustion engines to little avail. Remember the Hongqi sedan favored by Mao? You probably don’t; it was no world beater.

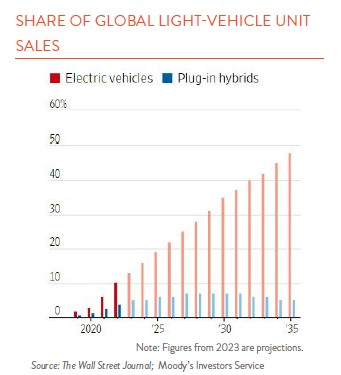

But electric vehicles are a “clean sheet” proposition. Legacy car makers and newbies alike have to toe the same starting line to prove their products. The Chinese have gotten out of the gate fast. They are already the largest global electric vehicle market (including plugin hybrids) as well as the largest maker of these vehicles. I think there are four reasons why they may remain out front.

First, batteries are crucial. Lithium batteries account for 40%-50% of the cost of an EV, and if you can increase the power, decrease the weight, and reduce the cost, you are in the driver’s seat. China has six of the top 10 EV battery makers including CATL, which alone accounts for 37% of the global market.

Second, China does not have the “drag” of a legacy car business. Traditional car companies are trying to keep their big profit models spinning money (think the Ford 150 truck) while at the same time transitioning to EVs, all the while doing it with a workforce trained predominately in gas-powered car technology.

Third, EVs are basically computers on wheels. It is easier for tech companies to transition to making cars than for a car company to become a tech company. Chinese EV companies like BYD, Nio, Xpeng, and Polestar are racing ahead in areas like infotainment, ambient lighting, voice controls, and monthly, if not weekly, software updates transmitted directly to a car’s computer.

And finally, the Chinese government is supplying subsidies to their car companies faster and more efficiently than governments in the West.

What could derail China’s push into EV leadership? Geopolitics for one. China needs the vast U.S. car market, but China-U.S. relations may prevent this. Protectionism may reign. In addition, car manufacturing is a scale business. With the exception of BYD, Chinese EV makers have to prove they can produce quality models at volume.

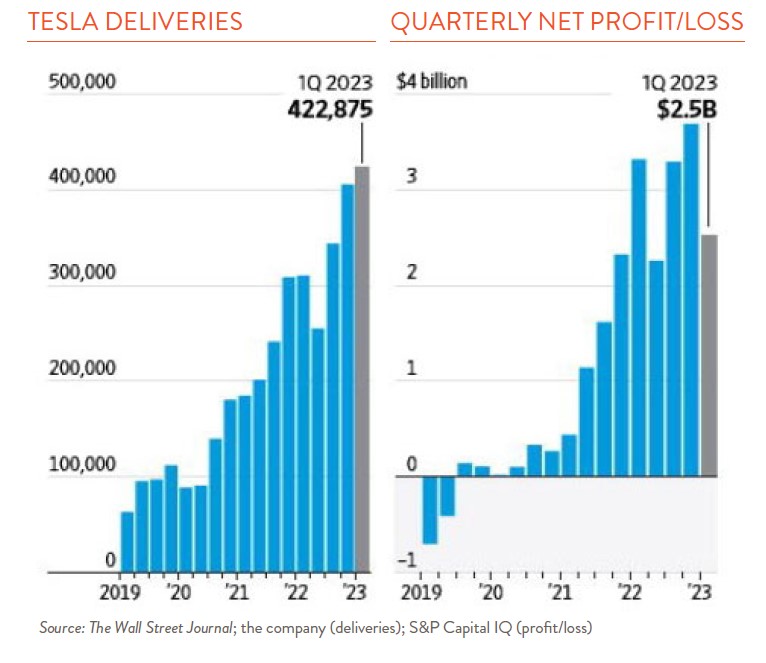

The truly big winner in EVs so far is Tesla. The Chinese are probably its equal in software but not in reputation or sales. The cynic in me sees a China problem for Tesla. China has a long history of inviting in Western tech, only to learn (steal?) their secret sauce and transfer this to local competitors. Forewarned is forearmed.

If the Chinese have benefitted so far from EVs being a “clean sheet” business, others might also benefit. Saudi Arabia, Apple, and Foxconn are all interested in EVs, and all are loaded with cash. And don’t count out the legacy car makers. There are good reasons why they have survived for nearly a century. We are still in the early innings with EVs.