Health care is an enormous issue. For the elderly (over 65) it is not just about cost but also availability and choosing the right plan. Medicare, the government program covering hospitalization and outpatient physician costs for the elderly, was enacted under Lyndon Johnson in 1965. Before that you had to be lucky enough to have an employer retirement health policy or be able to afford insurance.

In 2006 prescription drug coverage was added to Medicare (Part D) and in 1992, Medigap policies, which cover costs not paid by Medicare (co-pays, deductibles, co-insurance, etc.), were standardized.

Medicare enjoys widespread support, but it is complicated — very complicated. In addition to Parts A and B (hospitalization and outpatient physician costs) there are 23 standalone Part D drug plans and 10 different Medigap plans. It can be overwhelming.

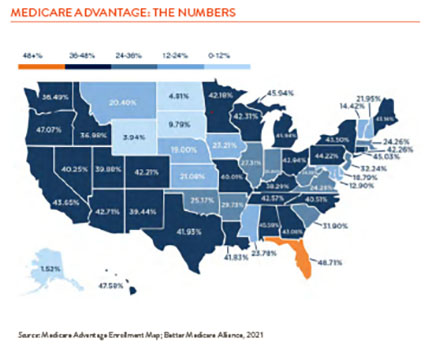

Then along came Medicare Advantage plans (MA) in 1996 promising private sector competition, lower total costs and easier to understand plans. On this last point, ease of understanding, they have certainly been successful. A full 42% of Medicare recipients today are now enrolled in MA plans. This number is expected to rise to almost 60% in the not too distant future.

MA plans in theory (and the devil is always in the details) offer the same services as Medicare and many offer more, including some dental, vision, hearing, and transportation services. And they do it all for one price. No more having to research a zillion different add-ons.

The government pays MA plans about $1,000 a month to cover enrollee health care. The plans then need to shoehorn your health needs into this amount and earn a profit. The plans are all slightly different but in general they recruit a list of physicians and hospitals that agree to work within the insurance company’s fee structure. A primary care doctor is the gatekeeper responsible for your care and the one who will refer you to a preset list of specialists and hospitals. This is all fine if your doctor is in the plan, and you are comfortable with the specialist list.

Are MA plans more cost effective than traditional Medicare? Where you stand on this one depends on where you sit. The Kaiser Family Foundation finds that MA plans cost the Government $321 more per year per participant than traditional Medicare. This adds up to $7 billion annually. Other studies, however, show that MA plans save the government up to $5 billion a year. Take your pick.

And which approach is better for the consumer? Traditional Medicare is front- end loaded meaning you pay upfront monthly fees for Part B, Part D, and Medigap. When you get sick, additional costs are generally not a significant surprise. MA plans are back-end loaded. You pay a small monthly participant charge (in addition to your Part B fee), and if you stay healthy your health care costs are predictable. But when you do get sick, costs can escalate quickly.

The decision on how you get your Medicare boils down to how you define peace of mind. If you like the idea of “set it and forget it,” one price for everything, and you are comfortable with the doctor and hospital list, and you are in reasonably good health, MA plans look attractive. If you like the idea of knowing up front the bulk of your costs, and you want the freedom of choosing your own physicians and hospitals, traditional Medicare is probably the better choice. No easy decisions in life!