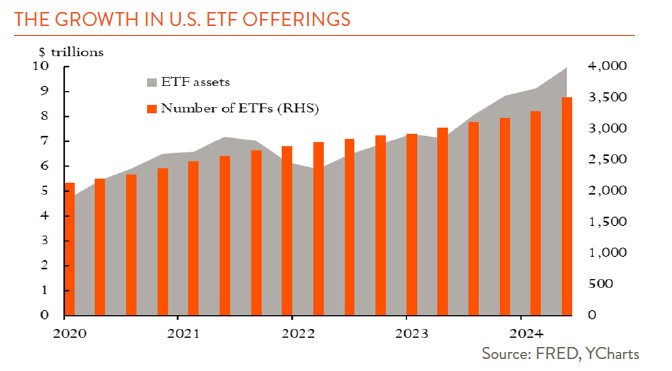

In the ever-evolving world of finance, it feels like there’s an announcement of a new ETF almost every day. Over the past five years, the number of exchange-traded funds (ETFs) in the U.S. has skyrocketed from approximately 2,000 to over 3,500—a staggering increase. So far this year, nearly 400 new ETFs have entered the market.

These trends become even more striking when juxtaposed with the shrinking universe of publicly traded companies. At its peak in 1996, the U.S. had nearly 7,300 publicly traded companies. Today, that number has dwindled to around 4,300, largely due to the rise of private equity as well as merger activity. That means we may soon see a world where the number of ETFs exceeds the number of publicly traded companies they are designed to track. If you take mutual funds and ETFs together, we have already well-surpassed that number, with funds outnumbering stocks by around 3-to-1. And who said you couldn’t do more with less?

With thousands of ETFs now available, most of the obvious ideas, like ETFs that follow the S&P 500, have already been established. And so, as ever, finance has gotten creative. In the world of ETFs, innovation has meant ever more niche offerings.

Many new ETFs cater to very specific markets or themes, including social issues, religious beliefs, or unconventional investment philosophies. Examples range from ETFs focused on climate change (e.g. ticker “TEMP”) and fossil fuels (DRLL) to those targeting pet care (PAWZ), biblical values (BIBL), and even Republican donors (MAGA).

Here are examples of some of the more exotic ETFs:

- Unusual Whales Subversive Democratic Trading ETF (NANC) and the Unusual Subversive Republican Trading ETF (KRUZ): These hold publicly traded companies that members of the U.S. Congress or their families have reported holding and cynically refer to Nancy Pelosi and Ted Cruz.

- Procure Space ETF (UFO): This ETF focuses specifically on technologies related to the commercialization of space, including satellite and defense companies.

- Leveraged, Inverse, and Single Stock ETFs: Investors now have access to ETFs offering leveraged or inverse exposure to individual companies. For example, TSLR delivers 2x the return of Tesla stock, while TSDD provides -2x the return. If your preference is a more modest 1.25x exposure to Tesla, there’s an ETF for that too (TSL).

If all of this is starting to sound like a casino, you would not be far off. It seems that whatever bet you want to make, it can be expressed through an ETF. Now, not all this growth in the ETF market is bad. It does provide more options for investors, but it also raises critical questions about risk, sustainability, and the overall benefit. With so many niche products, distinguishing between valuable innovations and fleeting gimmicks is becoming more critical than ever. Investors must navigate this complex ecosystem carefully, weighing the benefits of targeted exposures against the risks of too much leverage, over-crowded trades, and pure speculation.

The proliferation of ETFs also has blurred the lines between active and passive management and redefines how investors think about ETFs. Historically, ETFs were synonymous with passive investing, providing an efficient way to gain broad market exposure. These funds provided the potential for lower costs than mutual funds and the ability to trade throughout the day. Now, some of these levered and other active ETFs might charge as much as 2%-3% per year for the privilege of investing in them.

While we would never want to underestimate the lengths some in the industry might go in the name of financial innovation, we are starting to wonder if we are approaching the ETF saturation point. How much longer can this go on? We are all for greater accessibility and opportunity, but these developments may be creating confusion and inefficiency. Our hope is that investors are at least taking care to understand what they are buying and the associated risks and costs.