Why is the stock market performing so well given the extreme level of political, economic, and social uncertainty today? We have been getting different versions of this question a lot recently. Making sense of financial market prices can indeed be challenging – on any given day they reflect a mix of both economic forces and investor sentiment. But if you take a longer-term perspective, the answer to this question becomes clearer.

First, let’s acknowledge just how good things have been for investors recently. All three major U.S. stock indices are near record highs. The S&P 500 is up almost 12% so far this year – a very respectable increase considering the 25%+ returns logged in both 2023 and 2024. International stocks produced strong double-digit returns in each of those years as well and are outpacing their U.S. counterparts year-to-date, up just under 16%. After a few anemic years, U.S. bonds have bounced back advancing 6% since January.

We should also acknowledge the negative news confronting investors this year. Ever-shifting trade policy has increased costs for a range of businesses and complicated their planning efforts. Political conflicts rage in several areas around the globe. Developed countries are struggling to rein in growing debt burdens, while back at home, questions around Federal Reserve independence continue. While I am sure each of us has our own list, these are a few of the things that keep me awake at night.

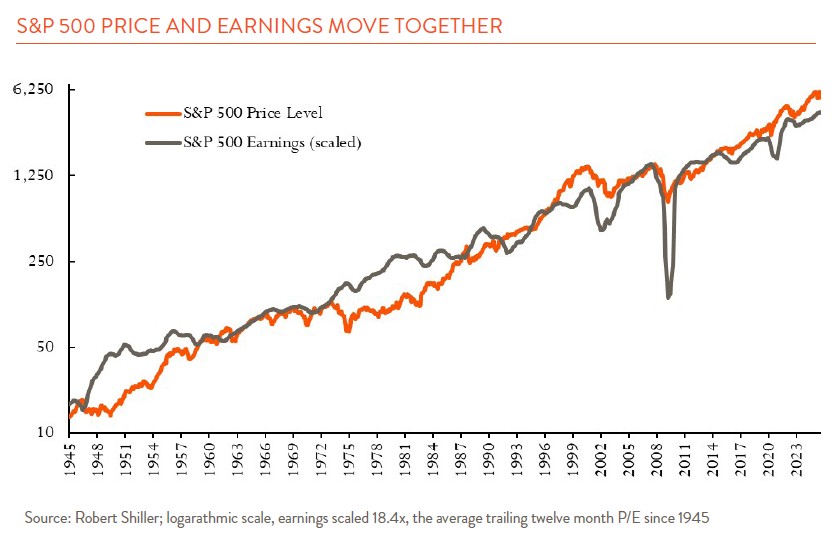

To understand why these issues and others have not weighed down the market, it helps to first examine what drives share prices. Investor concerns can greatly influence stock prices over short periods of time, but over the long term it is corporate earnings growth that matters. Between 2001 and 2024, for example, earnings growth for companies in the S&P 500 tracked their share price gains with each rising 7%-8% annually. Corporate profits are expected to rise another 8%-11% in 2025 and 13% in 2026. Strong economic fundamentals, including still low unemployment and interest rates, and the unprecedented levels of AI-related capital spending, are helping support these buoyant forecasts.

It is also important to remember that while stock markets dislike uncertainty, they tend to react to what is known (and quantifiable) rather than speculation. This is particularly true in the current environment where the timing and ultimate economic effects of a number of critical issues are so uncertain.

U.S. stocks’ resiliency, however, is not guaranteed. Several of the “legs” holding up the market to date are starting to look a little wobbly. A softening job market and uptick in auto loan and credit card delinquencies suggest consumer spending may come under pressure. Ever-widening federal deficits may well lead to higher long-term interest rates and the dampening economic effects that go along with them. Finally, after three years of double-digit returns, share prices are no longer cheap. The “Buffett Indicator,” which compares the total market value of the country’s publicly traded stocks to GDP, now stands at a record 2.1x. On a P/E basis, the S&P 500 trades at 22.2x forward earnings, above its 17.0x thirty-year average.

If stocks are overvalued, why shouldn’t investors sell now? Unfortunately, the valuation metrics mentioned above have historically proven unhelpful when trying to identify market turning points. And, although the markets may seem expensive on average, that does not mean that all stocks look overvalued. Individual sectors or shares (especially outside of technology) appear more reasonably priced today, as do international stocks.

So, what should an investor do? It makes good sense to review your asset allocation (mix between stocks, bonds, and cash) to be sure it is in line with your return goals and risk tolerance. If the allocation still makes sense, rebalancing back to the original target may also be warranted after the most recent run.