No one has actually asked us for our 2023 forecast, but it is customary this time of year to say something about the upcoming twelve months, so into the abyss we go. The problem is, as Hugh Hendry a British hedge fund manager has said, none of us have been to the future so we really have no idea of what we are talking about. We agree, so we won’t be making a forecast here. Instead, we will write about what we think the consensus of Wall Street forecasters is today, both for the economy and the market.

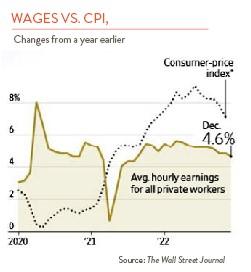

First, with regards the economy, roughly 90% of investors expect global inflation to be lower within the next 12 months, according to a Wall Street Journal story at the end of last year. The thinking is, as the global economy cools, and this includes the U.S., wage inflation will also cool (see chart to the right), which means inflation will peak and start to come down. The Fed can then stop pushing up short term rates and overall interest rates will decline.

But a cooling economy often means recession. The Economist notes that over the last half century whenever the inflation rate in the U.S. has reached an annual rate of 5% (spoiler alert, we are there now,) a recession has occurred. Are we in for a recession this time and if so, how severe? Howard Marks at Oaktree Capital, who does not believe in forecasters or forecasts, likes to say that “whenever we are not in recession, we are headed towards one.”

So, let’s say we get a recession in 2023 in the U.S. Severe or not so severe? According to The Economist again, a recession in the U.S. will not be severe. Why? First, there are still a lot of jobs available in the economy and not so many workers. Companies are going to be hesitant about laying off too many employees today, for fear of not getting them back on the other side. Second, the federal stimulus payments since March 2020 have been enormous. State governments are still sitting on $250 billion of stimulus cash they can use to paper over tax shortfalls and individuals are estimated to have $1.5 trillion in excess savings they can use in the event of layoffs.

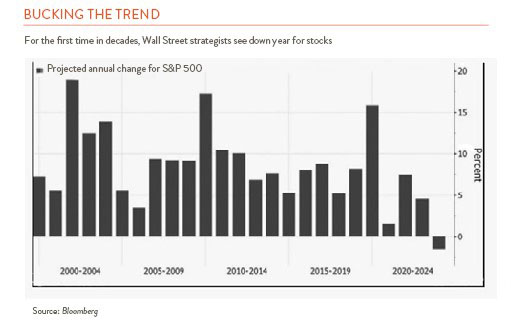

On the stock market front, an amazing forecast is out there if you believe Bloomberg (see chart below). As we all know stocks go up and they also go down, but that message hasn’t always gotten through to Wall Street forecasters. Not once over the past 24 years have forecasters in January said that the overall market would go down the next 12 months. Not after the tech crash in 2000, not after the housing debacle in 2008. Not once. And yet the market actually went down one third of those years. So now, the prediction is a decline in 2023. Is this overreaction or a sign of the apocalypse?

Where do we stand on all this? Lower interest rates and stock prices, or higher? We go back to Howard Marks, the forecast non-believer who notes that since 1920, we have had 17 recessions, a Great Depression, two World Wars, a pandemic, and a zillion other crises. And yet stocks have still returned more than 10% per year over 10 decades. Our recommendation is, block out the forecasts and stay focused on the long term.