The NFL Draft was held last month in Detroit to record-breaking fanfare. Over 770,000 fans attended in person and the event was broadcast on multiple networks and media platforms. But it’s not just spectacle, the draft has evolved into a highly strategic event and a dynamic marketplace for new players. As investors, when we see a market we often wonder, is that market “efficient”— meaning, do NFL teams price their talent accurately?

The draft’s structure is straightforward. Teams select newly eligible players, primarily from college, with the worst team from the previous season getting the first pick in each round. The second-to-worst team gets the second pick, and so on, down through picks and rounds until all players are selected. These picks can be traded, and the market has become very advanced. But that was not always the case.

The first big innovation came in the early 1990s. Jimmy Johnson, then coach of the Dallas Cowboys, developed a chart assigning specific values to each pick. For example, 3,000 points for the first overall pick, 2,600 for the second, down to the final pick worth just two points. The system gave Johnson a framework for draft decision-making, and he used it to great effect, completing 51 trades over five years. This was a big change, and Johnson’s success with the Cowboys, including multiple Super Bowl wins, led other teams to develop their own valuation charts, trade more strategically, and act on their improved sense of each pick’s value.

Then came the psychologists, who questioned how good teams actually were at putting a value on draft picks. Daniel Kahneman, the Nobel laureate who died in March, identified cognitive biases that cloud our judgement. Kahneman applied much of his work to the field of economics and how investors behave in financial markets. Leaning on his work, and recognizing similarities between financial markets and the NFL draft, economists Richard Thaler and Cade Massey studied the draft in research published in 2005.

They found that Kahneman’s “overconfidence bias”, so prevalent in investing, was also alive and well among NFL teams, which systematically overvalued early draft picks and undervalued later ones. They put too much weight on their ability to choose. The learning was that draft picks across rounds are more evenly valued than Johnson’s chart might suggest. “Trading down,” or swapping one first-round pick for multiple later-round picks, could exploit this bias.

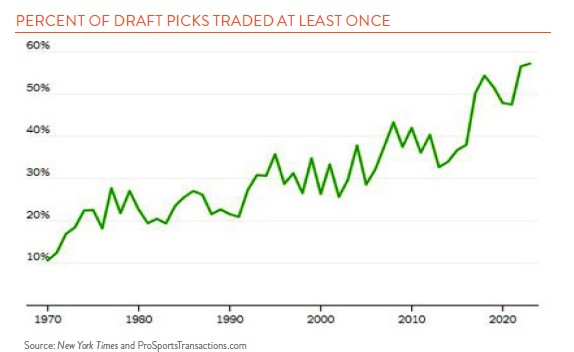

These insights have contributed to a rise in trading activity in the market for draft picks, with a recent New York Times article showing that the percentage of picks traded at least once has risen from 10% to over 50% since 1970 (chart above). Additionally, recent analysis from Dartmouth Sports Analytics indicates that trades now align more closely with predicted draft pick values, reflecting a trend towards a more analytical, data-driven approach and more efficient pricing.

But there are still plenty of examples of inefficient trading. Teams often get hyper-focused on a specific player and will trade away too much “draft capital” to move up and “get their guy.” For instance, in the 2023 draft, the Panthers traded a star player plus four draft picks to move up from the ninth to the first overall pick. Their selection ended up struggling in his rookie season.

Another issue might be the dazzle of headline statistics from the NFL Combine. This event involves scoring players on various drills like the bench press, vertical leap, and 40-yard dash. It’s not uncommon for teams to fall for impressive Combine results and overlook the player’s actual on-field performance. There are many examples of teams drafting speedy players assuming they can then coach them into good receivers.

One of the tricky things with cognitive biases is that being aware of them does not necessarily make us less prone to committing errors. Investors fall prey to this same trap all the time. As for the NFL, at least for now it seems teams are on a level playing field in terms of the analytical tools they bring to the draft.