We are almost there now…but this is not the timing the authors had in mind. The book, Dow 36,000, was written by James K. Glassman and Kevin A. Hassett and published in 1999. Their thesis was that stocks were worth a lot more than they were then trading at. In fact, an awful lot more. Stocks, they argued, should be four times higher and this level could be reached in three to five years (their “best guess”).

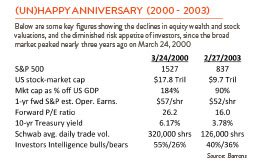

Boy did they miss the mark. As the chart to the right shows, the S&P 500 went down 45% from the peak in 2000 to 2003. The Dow did a little better, off “only” 30%.

But let’s back up and set the stage. The Dow in 1999 was trading at roughly 10,000, up almost continuously from the low of 777 in the summer of 1982. This amounts to a 16% average annual gain even before dividends are added back. A golden time for stocks.

James Glassman was the personal finance columnist for The Washington Post in the 1990s. I read all of his pieces. He was very good. He emphasized saving to the max, thinking long-term, limiting your trading, being careful about costs, and diversifying your holdings. He said all the right things.

Then came the book. Glassman and Hassett argued that although stocks are volatile over the short term, you might be up 40% one year and down 40% the next, over the long term, 20 years or so, you were almost certain to get a positive return, and the volatility of this return was very low. In fact, no more volatile than long-term Treasuries. And yet stock investors have historically gotten a return 7% more per year than bonds. The authors argued if this “risk premium” went away stocks would be 4X present levels. But this meant stocks would have to sell at 100X earnings, up from an already elevated 25X in 1999! It obviously didn’t happen.

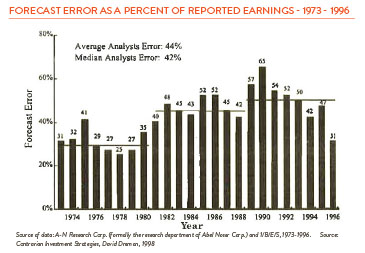

What are the lessons to be learned here? First, the future is uncertain. Be careful predicting it. The authors tried to forecast earnings five, 10, and 20 years out with a degree of precision that just can’t be done. David Dreman, the author and money manager, and Michael Barry of James Madison University studied analysts’ quarterly earnings estimates between 1973 and 1996. They looked at 94,000 different estimates and let analysts revise their estimates up to two weeks before the end of the quarter. How accurate were they? Not very (see chart in the lower left). Although this data is from the time of Glassman/Hassett, I doubt the record has improved since.

The second lesson from Dow 36,000 is that long-term investing still pays. We are at a market PE today not much different than 1999. Should we sell now? If you look back to 1999 and had invested at Dow 10,000 and then suffered through the 2000 Tech Crash and then the Housing Crash of 2008 and then all the political turmoil since, your return would still average 8% per year, with dividends added back.

Not everyone has 20 years to wait with their investments, and you should be diversified between long-term risky assets and short-term stable ones, but with your stock market money, the best advice still is to be patient and stay focused on the long term. It will pay off.