If you have spent much time with anyone under the age of 30 the last few years, you can be forgiven for thinking that online shopping is taking over the retail world. The shift to e-commerce accelerated during the pandemic as even the most digitally unaware worked to avoid in-person contact.

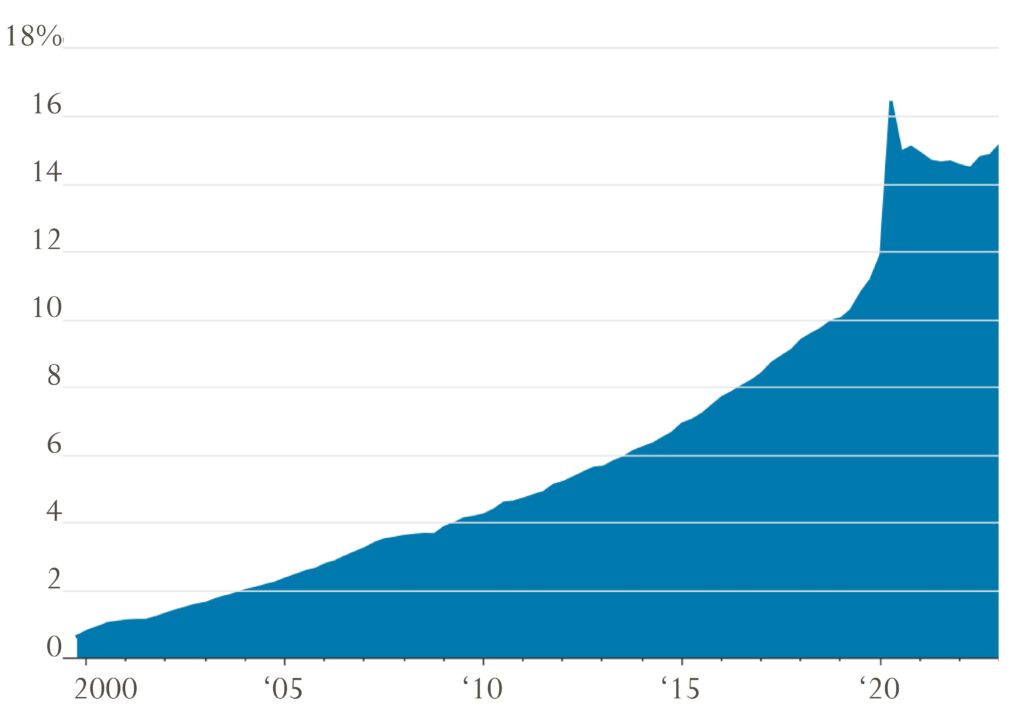

In 2020, for example, e-commerce sales exploded 44% to almost 13% of total

retail sales. But as the chart below shows, an interesting thing has happened since

then. While online shopping has continued to grow in popularity, its share of overall retail sales has stabilized in the 12%-15% range. Several factors are contributing to the recent slowdown in e-commerce sales growth.

First, for many retailers, selling online has gotten more expensive and less productive.

On the cost side, the increased demand for digital advertising space has led to higher costs. Oberlo, a Shopify app that helps retailers source and ship products, reports that digital ad spending is expected to total $869 per internet user in 2023, a 9.5% increase from 2022 levels.

Meanwhile, on the productivity front, Apple’s 2021 move to improve iPhone user privacy reduced advertisers’ ability to reach desired customers. Higher prices for a less effective product are generally not a recipe for success.

E-COMMERCE SALES AS SHARE OF RETAIL SALES

Source: Commerce Department & The Wall Street Journal

Note: Seasonally Adjusted

Shipping delays during the pandemic too left many online retailers with a

heightened sense of the risks associated with outsourcing this key component of their customers’ experience. Finally, returns have become an increasing cost for most online retailers. Merchandise returns require retailers to carry higher than otherwise necessary inventory levels and, often, accelerate markdown activity. Narvar, a return management company, estimates that retailers spend on average $26.50 on return-related shipping, warehousing, and labor costs for every $100 of merchandise. Retailers today are using a number of strategies to manage these costs, including notifying customers in advance of

high return items, offering financial incentives for accepting no-return policies, and offering in-store return options.

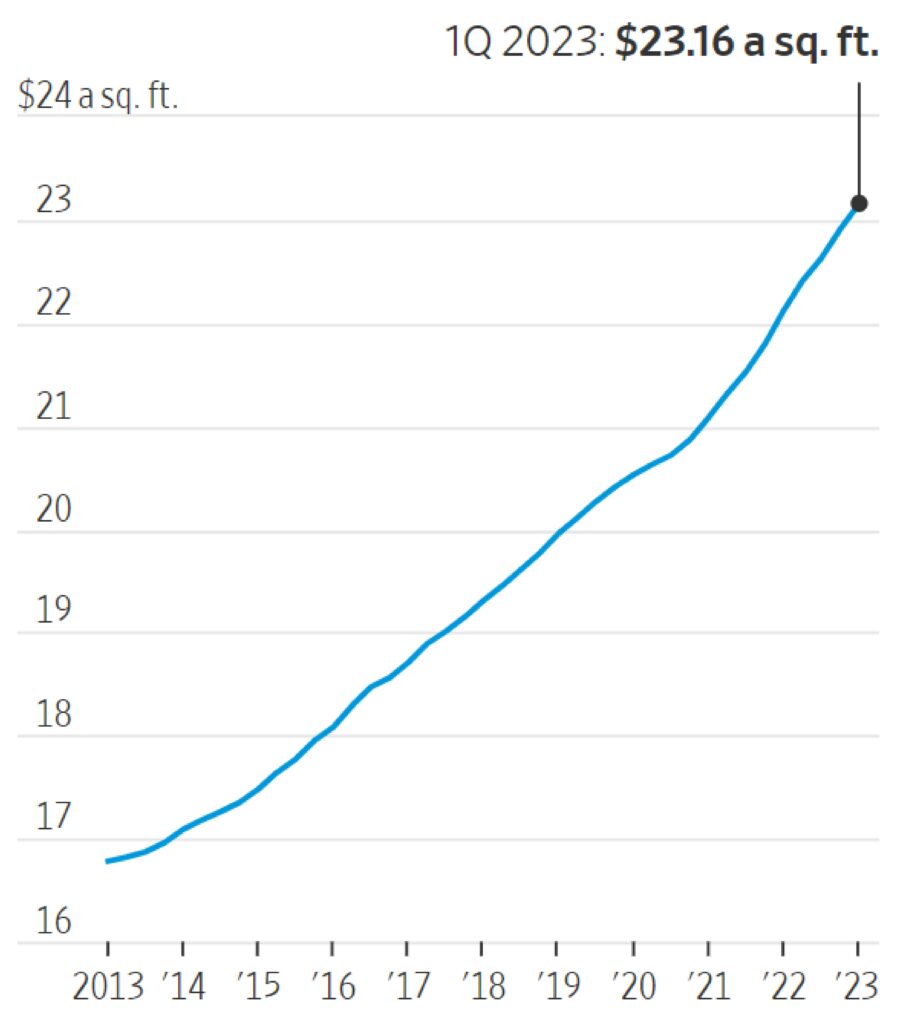

While online shopping has become less appealing, the benefits of in-person shopping are becoming more apparent. Of course, some of the recent appeal of bricks-and-mortar shopping may simply be a short-term phenomenon tied to customers’ post-COVID embrace of in-person experiences. But I think there is something more enduring at work here. Over the past decade, retailers have developed deeper insights into when online shopping makes sense and when it does not. Certain products, think furniture, footwear and cosmetics, are simply better sold in person. Warby Parker, originally an online-only purveyor of eyewear, today is fully embracing the benefits of the in-person shopping experience. In addition to its robust web presence, the company now operates 200 stores throughout the U.S. and Canada. It plans to open another 40 stores this year and thinks that, ultimately, it can operate 900. At the other extreme, UK-based Primark has decided not to sell online at all although it does use digital tools to market to its customer base. The still healthy demand for retail space in the U.S. (see chart ) amidst a particularly difficult time for commercial real estate further highlights the value now being placed on physical stores.

QUARTERLY ASKING RENTS IN SHOPPING CENTERS

Source: Cushman & Wakefield; Costar & The Wall Street Journal

Moving forward, success in retailing will require a nuanced understanding of how best to combine the benefits of both online and bricks-and-mortar selling channels. Examples of this today include the increasing use of “buy online, pick up in store” offerings and data analytics to optimize store locations. More innovations are likely to come. Retail will never be any easy business, but the last few years have shown that the industry’s best players can adapt to difficult and ever-changing conditions.