As Warren Buffett once said, “Investing is simple…but not easy.” There are only a few principles involved in being successful with money. Jonathan Clements, the Personal Finance columnist at The Wall Street Journal from 1994 to 2008, said there are only 25 different stories in Personal Finance. The trick, after you have written all 25, is to convince your editor that your next column is truly unique!

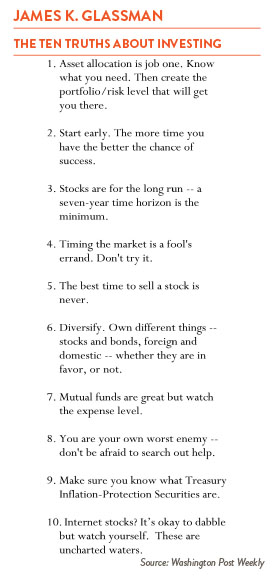

James K. Glassman was writing on Personal Finance for The Washington Post at the same time Clements was at The Journal. In his farewell print column in 1999, Glassman summed up what he had learned (see box to the right).

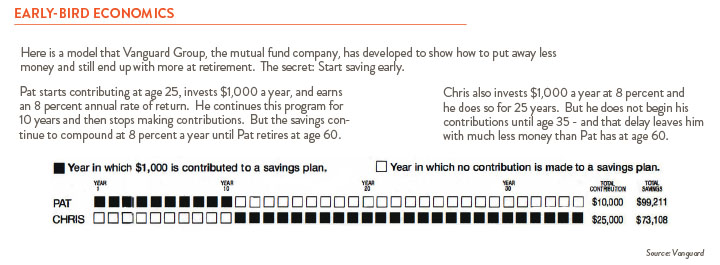

For me, the most important piece of advice is, save early and often. Many years ago, Vanguard produced a simple, and brilliant, chart showing the results of two investors. One started saving $1,000 a year and did so for ten years, then stopped. The second investor started saving $1,000 in year 11 and did so for the next 25 years. Investor #1 saved a total of $10,000 while investor #2 saved $25,000. Who ended up with more money? Investor #1, and the reason is: the incredible power of compound interest, earning interest on interest each year. The moral is simple: save consistently as much as you can, as early as you can and let compound interest do the rest.

Peter Bernstein, one of the great investment minds of our age, once said that the most important investment lesson he learned is to avoid making predictions about the future. It just cannot be done, so don’t bet your investment success on it. James Glassman unfortunately did just that and — ugh. In 1999, he along with Kevin Hassett wrote, “Dow 36,000,” in which they predicted the Dow could reach 36,000 by 2002-2004. At the time the Dow was at about one third this level. Today, 22 years later, we are finally — maybe — reaching this level. The future is very uncertain!

We all must deal with the future and make judgments. I realize this. But don’t be dogmatic about your projections of the future. Invest long-term, diversify, and most importantly, be patient. You will be surprised; your financial future will work out.