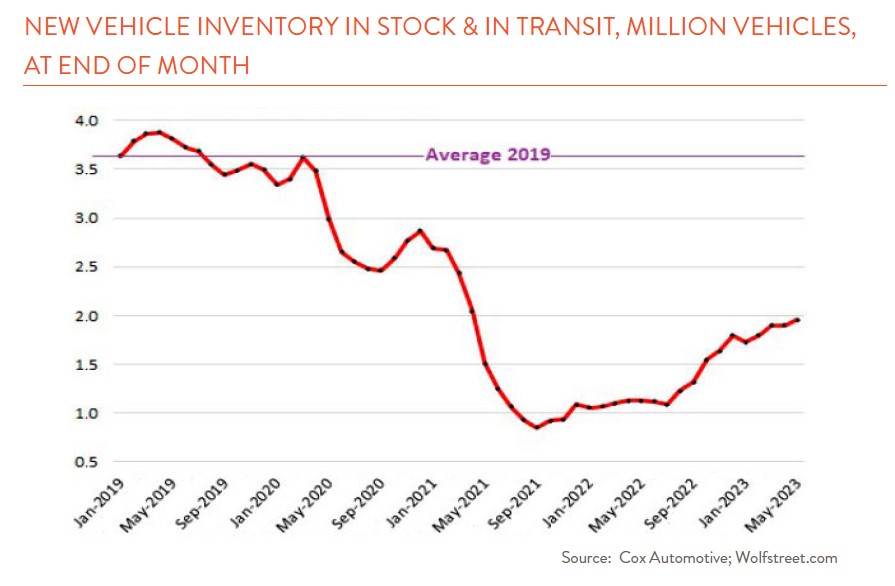

Few industries were as hard hit as the automotive sector during the pandemic. Supply chain disruptions, most specifically a shortage of semiconductor chips, sent production levels plummeting across the globe. Here in the U.S., new vehicle inventories fell from just over 3.5 million in early 2020 to below 1.0 million in the summer of 2021 (see chart below). Consumers faced with limited inventories and long wait times have hung on to their existing cars, bringing the average age of vehicles on the road to an all-time high of 12.5 years.

Fortunately, production levels are now recovering and inventories on dealer lots are slowly getting back to the 60-day level that is generally considered “healthy.” As a buyer, however, your bargaining power today may vary. Some brands such as Jeep and Infiniti are reporting over 100 days’ supply while popular brands like Toyota, Honda, and Lexus have less than 30 days.

Unfortunately for buyers, recent supply shortages and general inflationary pressures over the past few years put upward pressure on prices. The average new vehicle today clocks in at just over $47,000, more than 30% above where it stood just four years ago. One might expect that in this environment, consumers would turn to leasing, traditionally a lower cost option for financing a car, but the reverse is happening.* Before the pandemic, roughly a third of new car buyers leased their cars while today, fewer than 20% do. At least three factors are making leasing less appealing. First, higher interest rates and sticker prices and steady residual values have combined to bring lease payments more in line with traditional car loan payments. Second, lease holders, faced with a limited supply of new cars, have increasingly decided to buy their cars at the end of their lease terms. Finally, Cox Automotive reports that to boost profits, automakers have cut back on lease incentives to boost more profitable new car sales.

So how should car buyers approach financing options given the new realities of today’s car market? As has long been the case, the cheapest way to own a car is to purchase one with cash and hold it until the repair costs become uneconomical. If, like many people, you need to finance your car purchase, you will need to sharpen your pencil. While leasing has become generally less financially attractive, it may still make sense. To evaluate the all-in cost of leasing a car vs. financing with a loan, potential buyers will need to consider the interest rate on the loan vs. the “money rate” embedded in the lease, upfront costs, taxes, and insurance. Manufacturers are slowly reintroducing incentives as inventories recover and these should be factored in. Car buyers will also want to know the residual value embedded in the car lease as higher values here work to lower your monthly payments and may help with possible resale should you decide to buy out the lease at its end. If all this seems daunting, a number of online calculators can help with the number crunching.

Leasing makes sense for drivers who put a limited number of miles on a car (generally less than 10k/year) and/or want to eliminate the financial risk associated with car maintenance – generally, these costs fall on the dealer. Finally, there is the emotional piece of car ownership. Many people like the idea of owning a new car every few years. Leasing is the best option if this is your goal, but in today’s environment, you will need to keep a close eye on lease inventories to be sure your next car will be available when your lease expires.

*Lease payments are generally lower because under a lease you are only financing the difference between the car’s purchase price and its value at the end of the lease (the residual value) while under a car loan, you are financing the entire purchase price less your deposit.