At the start of the global financial crisis in 2008, Spain fell into a prolonged recession, compounded by the European debt crisis in 2010-2012. The country’s real estate bubble burst and the ensuing fallout engulfed the banking sector, leading to a €100 billion bailout from the European Union. Unemployment spiked to around 27% by 2013, up sharply from under 10% in 2008. Given the anemic GDP outlook and lack of investor confidence, Spain appeared likely to lag well behind larger European economies like Germany.

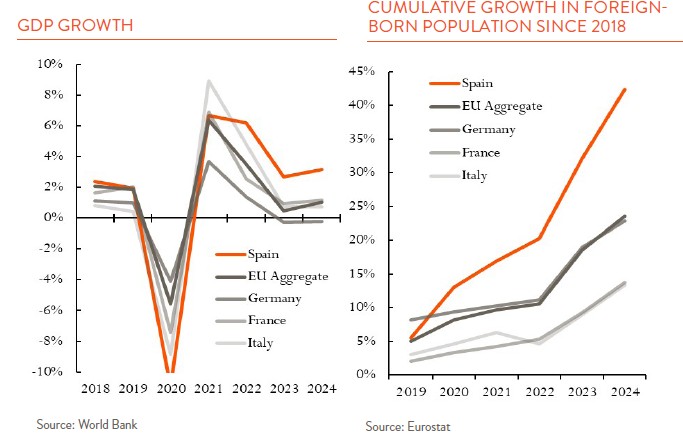

A little over a decade later, the story has changed as the Spanish economy grew by 3.2% in 2024, more than triple the Eurozone average of 0.9%. Its growth smashed large peers, with France only up 1.1%, Italy up just 0.7%, and Germany contracting by 0.2% (see chart below). Despite concerns about the global impact of the new U.S. tariff regime, the Organization for Economic Cooperation and Development (OECD) projects a 2.6% GDP growth rate in 2025 for Spain, well ahead of Germany (+0.4%) and France (+0.6%). Unemployment has also improved tremendously, falling to 10.3%, the lowest since 2008. So, what drove this amazing turnaround for Spain?

It is hard to ignore the impact of the Spanish sun. Spain is the most visited country in Europe and tourism’s contribution to GDP is substantial, with the country’s National Institute of Statistics putting it around 12.5%. But that’s not new—apart from the Covid years, tourism has always been strong. While tourism receives a lot of credit, there are a few other key factors, some of which have been at work for a decade.

First, the reforms put in place after the Eurozone crisis. In the mid-2010s, Mariano Rajoy’s Partido Popular, following the old adage to “not let a crisis go to waste”, reformed to the banking sector and the labor market. Banks were consolidated and made more resilient. Labor law changes reduced employer costs and led to a shift away from temp jobs, previously favored by many businesses. Other reforms helped increase labor mobility and skills-job matching.

There was also a focus—at times in the form of grants and co-investment—on higher value-add service industries like telecommunications, real estate, and information technology over manufacturing. Since the fourth quarter of 2019, thanks to higher productivity, these sectors have grown faster in Spain than in the Eurozone as a whole. Spain adopted specific policy goals to expand wireless broadband access, grow renewables, and digitize small- and medium-size businesses. Renewable energy, for example, has been booming, especially after the repeal of the so-called “Sun Tax” on solar in 2018. Solar industry employment has doubled since then, and the industry’s contribution to GDP has tripled. Spain’s renewable companies have grown to have a global presence, with firms like the electric utility and wind powerhouse, Iberdrola, surpassing €100 billion in market capitalization.

Part of Spain’s growth can also be attributed to a shift in immigration policy. After Rajoy, Pedro Sanchez’s Spanish Socialist Workers’ Party made it a priority to welcome immigrants. Spain’s foreign-born population growth has far exceeded the rest of Europe, increasing by a cumulative 42% since 2018 (see chart below). Sanchez has also made it easier for undocumented migrants to get healthcare and eased restrictions on work. These measures have helped fuel workforce growth—helpful in otherwise aging Europe. And Spain’s immigrants have generally been more skilled, with 70% having medium or high education levels in 2022, up from 55% in 2008, and versus 60% on average across France, Italy, and Germany.

While Spain’s special draw as a tourist destination is important, there are still lessons for the rest of Europe. First, unpopular or difficult policies may reap rewards in the future. Second, targeted (skilled) immigration could drive additional growth in specific sectors, and, in general, growth in a younger labor force from immigration could provide a long term demographic benefit. Finally, targeting specific industries can stimulate private investment and help develop more valuable sectors of the economy.