Today’s investment headlines are chock full of articles debating whether a bubble is brewing in AI-related technology shares. Investor concerns on this issue are well-founded. According to JP Morgan, AI-related stocks have accounted for 75% of S&P 500 returns, 80% of earnings growth and 90% of capital spending growth since ChatGPT was first launched back in November of 2022. The risk to the market is further highlighted when you consider that the “Magnificent 7” stocks (whose fortunes are disproportionately tied to AI) now represent approximately 34% of the S&P 500’s value.

To better understand the opportunities and risks associated with this latest innovation, let’s step back and review the technology and its evolution over the past three+ years.

Large language models (LLMs) are one of the core technologies supporting AI. By utilizing large amounts of data and some sophisticated programing, LLMs can be “trained” to predict the most probable next word in a sequence. While these models have been around for years, Open AI’s ChatGPT expanded on their capabilities by producing very human-like responses to questions over long, multi-turn conversations. In addition to being very user-friendly, ChatGPT excelled at understanding both nuance and context.

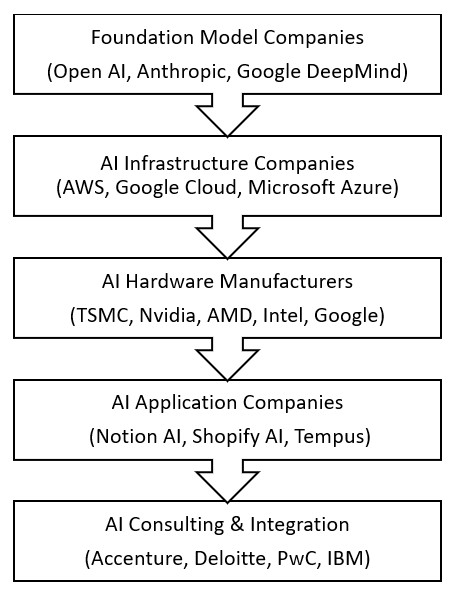

But a lot has changed since ChatGPT’s release. Excitement around the potential of this potentially game-changing technology has drawn hundreds of billions of dollars into the industry. Much of this cash has been spent building out the vast amount of computing capability required to train the LLMs which underpin AI. Meanwhile, whole categories of firms serving various parts of the business have emerged. The chart to the left (yes, created with the help of ChatGPT) outlines the various industry participants and the role they play today.

The companies that developed the large foundation models on which AI operates were the original driving force behind the technology. Some of these, like OpenAI, remain private but many are now publicly traded. While they have attracted billions, the path to profitability for these firms remains a work in process as they struggle to bring in sufficient revenue to offset escalating capital spending needs.

AI infrastructure firms provide the tools and data centers needed to build and train AI systems. Cloud providers like Amazon and Google fall into this camp as do less well-known firms like Databricks and Labelbox. AI hardware manufacturers design and manufacture the equipment that powers AI training. This sector, led by leading chip firms like TSMC and Nvidia, has been one of the biggest beneficiaries in the race to build out computing capability.

AI’s ultimate productive use is one of the biggest questions on investors’ minds today and this is where the AI application companies come in. These firms, many of which are software providers, are integrating AI into their offerings. The end markets here can be quite broad (Grammarly checks for spelling and grammar errors in real time) or narrow (Insilico helps accelerate the design/discovery of new drugs). Thanks to the complicated and quick-moving nature of this technology, a full range of consultants have popped up to help companies assess how best to utilize AI. While this discussion describes the unique roles of each AI firm, some are also involved across a few layers of the landscape. It is important to note too the more recent trend of industry participants combining their efforts, through either joint ventures or outright acquisition, to achieve strategic advantage.

What might cause the outlook on AI to change? Anything that slows the pace of its adoption such as stricter regulations or the inability of end users to justify further AI investment. The introduction of a cheaper/more efficient alternative to current industry standards (think the release of China-based DeepSeek earlier this year) could accelerate adoption but unseat incumbents. Other forces, such as a change in the interest rate outlook or further global trade conflict, could hit high-flying AI stocks particularly hard.

As has been the case in past periods of technological innovation, the path forward is unlikely to be straight. For now, we are paying close attention to how AI is impacting our portfolio holdings while asking ourselves what we believe are the two most important AI-related questions today. First, what are the actual productivity enhancing applications of AI and second, who will make money off its adoption? Stay tuned for future articles on these questions.