My wife Xin and I recently spent five weeks in her hometown in China, 180 miles south of Shanghai. Zhoushan is a series of islands now connected to the mainland by modern bridges and high speed expressways. The population is small by Chinese standards, only 700,000 residents. Zhoushan is a major fishing port and best known in China as the site of a sacred Buddhist mountain and temple, Putuoshan. Thousands of devotees visit annually.

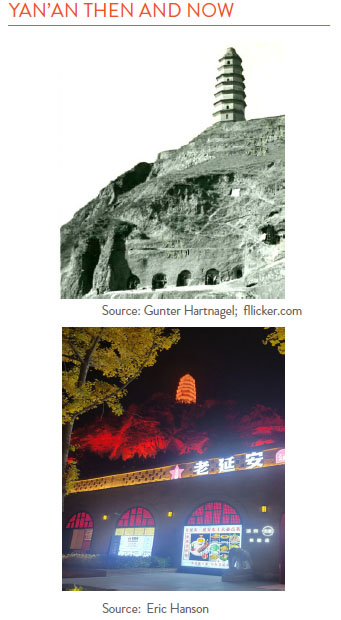

Over the past 40 years, China has had an amazing economic run. It grew at an average of 9% per year, pulling over 800 million people out of abject poverty and building an affluent and growing middle class. Yanan (see photos), home of the Communist army over 1935-1947, shows the dramatic changes in China. But some argue this has only been achieved at the cost of restricted human rights and authoritarian policies that are getting even tougher under Xi Jinping.

In terms of Great Power politics, I think the 21st century will be about the evolving relationship between China and the U.S. Some worry about a Thucydides Trap here, the possibility of war when a rising power (China) comes up against an existing power (the U.S.). There is no doubt that the U.S. is afraid of China today. We argue China steals our ideas and restricts its internal market, while China asserts the U.S. is denying it its rightful place in the global economy.

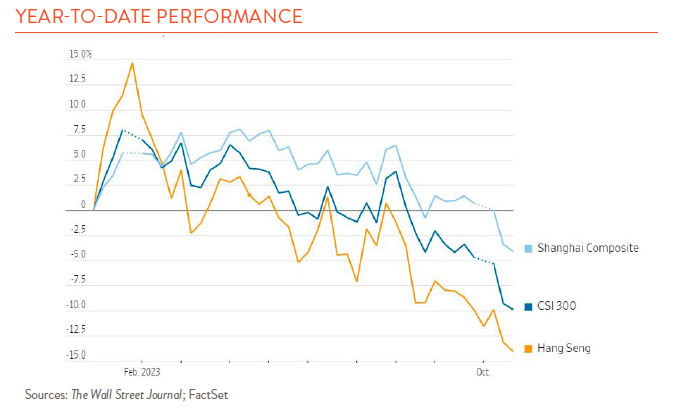

For all its incredible growth, has China been a good investment for Western investors? The answer is overall, no. The big problem for investors is that shareholders in China are not given top priority. Serving the wishes of the Communist party comes first. Shareholders, especially western shareholders, are a distant afterthought. Everyone should visit China to see its amazing development, but be wary of the stock market today.