Investors today can be excused for falling out love with bonds. Historically, the asset class has produced 5%-6% returns over the very long term. However, in the year just ended, the Bloomberg Aggregate Bond Index, a broad measure of the U.S. bond market, squeaked out a 1.4% total return, and over the last five years, bond investors are, at best, breakeven.

To better understand these results and the path forward, it helps to step back and look at what drives bond returns. When interest rates in the general economy fall, the yield offered on existing bonds looks comparatively more attractive, and their prices rise. Most investors’ experience with bonds reflects just this behavior. Interest rates over the 40 year period beginning in 1982 were generally in decline, unleashing a bull market in bonds. But those happy times ended in 2021 when pandemic-induced inflation ushered in a period of rising interest rates. And just when the Federal Reserve’s efforts to tame inflation seemed effective, in the fourth quarter of 2024, public policy uncertainty, resurgent inflation fears, and a still strong economy sent interest rates back up and bond prices tumbling once again.

In the face of all this volatility and uncertainty, why should investors consider bonds today? Many factors indeed support the case for higher interest rates (and lower bond prices) moving forward. Many of the incoming administration’s anticipated policy initiatives, including higher tariffs and restricted immigration, could reignite inflationary pressure and the need for higher rates. Continued rising federal deficits could fuel higher rates from an ever increasing supply of Treasuries. Finally, higher rates may be needed to cool the U.S. economy which continues to show surprising resilience. But it is important to remember too that much of the above narrative is already factored into current bond prices. As recently as last fall, investors, assuming a slowing economy, expected the fed to cut interest rates as many as six times over the coming year. Today, they expect only one rate cut in the second half of the year.

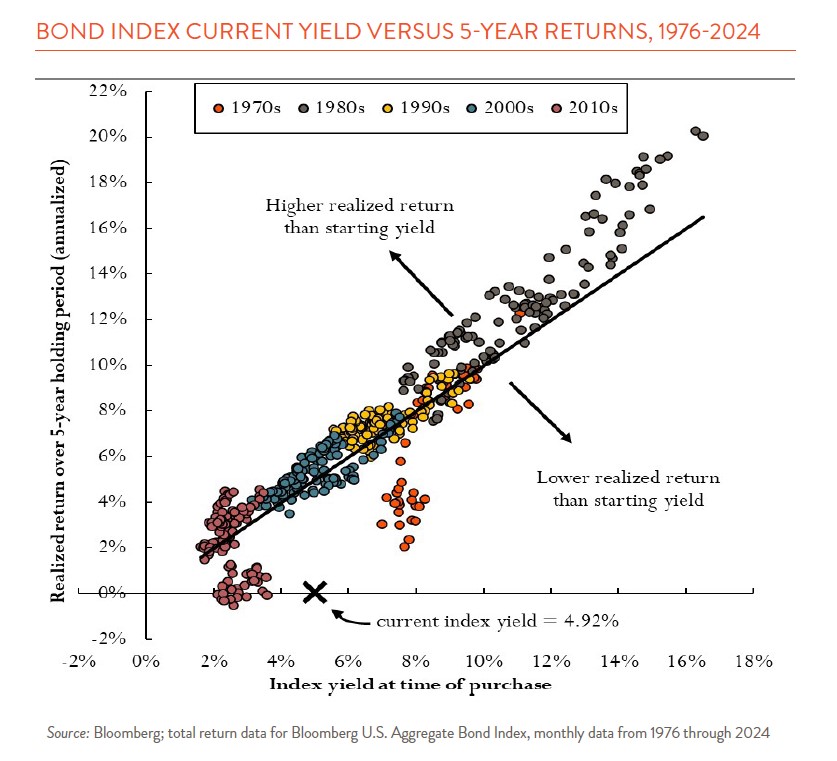

Stocks’ current lofty valuations also make bonds look more appealing today. Over the past two years, the S&P 500 has gained more than 50%. Some of this move is justified by the strong earnings growth produced over the period, especially in a handful of larger technology holdings. But valuations, or the amount investors are willing to pay for every dollar of earnings, remain elevated with most metrics now trading well above long-term average levels. In the past, investors simply had to accept higher valuations in the face of returns from competing asset classes, most notably bonds. That is no longer the case with intermediate term bonds now offering a current yield of just over 4.9%. As the chart above shows, this starting yield has been a fairly good predictor of the returns investors can expect from bonds over the ensuing five-year period. Finally, in a return to a more “normal” relationship, for the first time in some years, the nominal yield on bonds is higher than the return offered by cash and the expected rate of inflation.

Short-term interest rate predictions, and by extension bond returns, are notoriously difficult to get right. Bonds could suffer another disappointing year if interest rates remain at elevated levels or inch higher. But the positive inflation-adjusted returns bonds offer today make them more attractive than they have been in several years. This fact, together with their lower volatility, makes them a suitable option for those looking for smoother sailing in investment markets over the long term.