Some say this may be the biggest investment bubble in the world today. Let’s do the math and see. China has been on an incredible growth curve since 1979. The economic initiatives Deng Xiaoping put in place in the late seventies have lifted more people out of poverty, more quickly than has ever been done by any country in history. Eight hundred million people, previously impoverished, are now able to participate in the market economy. Many are middle class and able to buy apartments, cars, travel abroad, etc.

But I am getting ahead of myself. Let’s do the back story. As people in China got wealthier, they had money to invest. The stock market was considered a gambling casino, banks paid little in interest, and the bond market had not really developed. Housing was the investment of choice. It offered needed shelter and was turning into an investment that appreciated.

Land is owned by the state in China, and since there is no property tax (let me repeat this for western readers – no property tax in China!), municipalities needed a way to raise revenue. They found the secret elixir — sell property to developers, who in turn would build apartments. And we are not talking about building duplexes and triplexes. No, the developers planned projects consisting of, for example, 10 apartment towers,18 floors each, three apartments per floor for a total of more than 500 apartments. We have all seen pictures of these. Consumers were willing to buy since they needed a place to live, and they saw prices going up, but there was a catch. Developers required 100% payment up front (yes, 100%) for an apartment that might not be completed for two or three years. So, if you took out a mortgage, you started paying well before anything was in hand.

But not to worry, everyone was making money. This was the ultimate perpetual income machine, it seemed. Municipalities got their revenue, developers got their money upfront in presales, and consumers saw apartment appreciation even before delivery. Wow, what could

possibly go wrong here?

The trend is your friend except at both ends, as the old saying goes. And the trend has definitely ended in China for now. The economy has stalled, prices of apartments are flat at best, and consumers are balking at new purchases. Developers are going bankrupt because they have no presales to cover construction costs, and municipalities are not seeing new land sale revenues.

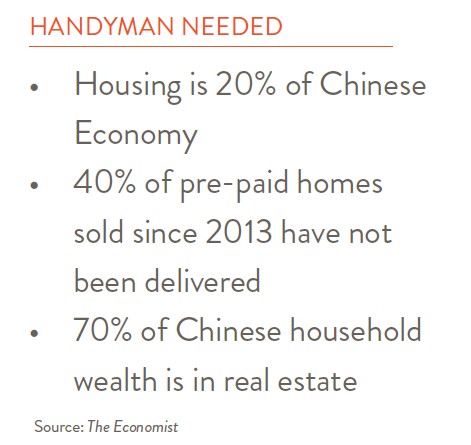

The Economist estimates that the real estate, sector makes up 20% of the Chinese economy, and 70% of Chinese consumer wealth consists of real estate. Here in the U.S., consumers certainly have real estate, but they also have stocks, bonds, and cash. Assets are more balanced; not so in China.

And the scariest fact, according to The Economist, is that 40% of presold apartments since 2013 have not been completed. This spells a lot of trouble — and potentially a big bubble. How big? We don’t really know. There are reports today of mortgage strikes by consumers who have borrowed money but have no apartments to show for it. The 20th Chinese Communist Party Congress is about to start October 16. Xi Jinping will almost certainly get elected to another five-year term. The government’s Job One will be to deflate the housing bubble while not throwing the economy into disarray. Stay tuned.