Two stock market truisms come to mind when I think about last year. The first is that “Markets climb a wall of worry.” The continued spread of COVID, rising inflation, and the threat of higher rates all weighed on investors’ minds in 2021. The second truism, “Don’t fight the Fed,” served as a kind of antidote to all this angst. Government support in the form of low interest rates, an ever-expanding Fed balance sheet, and robust federal spending programs helped support both the economy and stock prices last year.

Unfortunately, as we move into 2022 many of the same threats persist. The Omicron virus is dampening economic activity. Inflation continues to gain ground and the path to higher rates seems more certain than ever. In his recent congressional testimony, Fed Chair Jay Powell described inflation as a severe threat to the U.S. recovery and pledged to curb rising prices by winding down the bond buying program and, if necessary, raising interest rates.

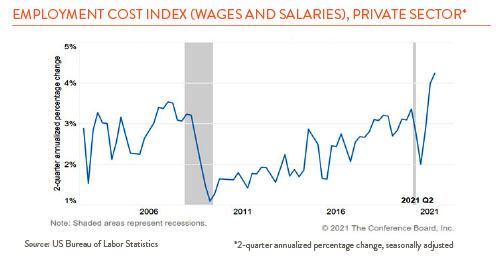

What does this kind of paradigm shift mean for investors? Let’s start with the bond market. Higher interest rates depress bond prices so a rising rate forecast can’t be good news for bond holders, right? Before you jump to sell your bonds, however, it is important to consider two things. First, bond investors have already priced in some of the upward move in rates, with three 0.25% increases widely expected in 2022. Further rate increases are possible if the Fed believes that inflation is becoming entrenched in consumer expectations and the economy more generally. To assess this, Fed officials will be keeping a particularly close eye on wage growth (see chart below). Wage gains tend to be “sticky” — once they rise, they tend not to fall back — and rising wages tend to cycle through to higher prices as companies attempt to pass their higher costs on to consumers.

Second, it is also important to keep in mind the role bonds play in any portfolio. Traditionally, bonds have both reduced portfolio risk and provided a measure of income. While the income offered today is limited, losses in bonds are nothing like the losses that can occur in the stock market in any given year. Consider that the worst one-year return in stocks over the last 70 years was a decline of 39% while the worst that bonds produced was a mere 8% drop.

When thinking about the outlook for equities, it is important to remember that only two factors drive stock prices in the long term; the growth in corporate earnings and the valuation level (often measured by the P/E ratio) that investors place on those earnings. Let’s consider each of these separately. Operating earnings of companies in the S&P 500 gained 72% last year as the economy rebounded from the pandemic-induced decline. While revenue gains contributed, most of the increase came from expanding profit margins. I think the opposite dynamic is likely to occur this year. Revenue gains should mirror a rebound in economic activity, but profit margins will be restrained by rising costs for everything from labor and energy to supply chain disrupted commodities.

On the valuation side, stocks are no longer cheap. At year-end, the S&P 500 was trading at just over 21x forward earnings estimates, well above the 25-year average P/E of 16.8x. Historically, P/E ratios have not been terribly helpful in predicting one-year stock returns but they have proven useful when predicting longer term results. Today’s elevated P/E ratio suggests muted annualized returns over the next five years.

The outlook for stocks today is less than exciting but I think there is some reason for optimism. Investors looking to put funds to work will find stocks attractive when compared to other fully valued sectors like bonds and commodities. Further, while stocks on average look expensive today, pockets of opportunity can still be found in select areas such as international shares, small cap holdings, and cyclically oriented sectors such as energy and finance.