Investors can be forgiven for tuning out the daily news on America’s ever-evolving trade policies. Hardly a day goes by without reports of either a new proposal or the reversal of an old one. In the face of all this uncertainty, the market consensus seems to be embracing two things. First, trade duties are back in force, whether used to generate revenue, bolster national security, or protect domestic industry. Second, markets are now, as a result, assuming higher levels of inflation moving forward. Survey results from Bloomberg show a one-year inflation forecast (CPI) of +2.6%, up from 2.2% last November.

As these survey results show, so far, the markets are betting that inflation levels will be manageable. To understand why, consider the expected impact of the proposed 25% tariffs on Mexican and Canadian imports and new 10% tariffs on Chinese imports. JP Morgan estimates that these duties (excluding the most recent additional tariffs on steel) applied to approximately $1.39 trillion worth of goods, will raise about $200 billion in revenues in 2025 or about 1% of what American consumers spend in any given year. While this average impact is small, it would hit some imports, such as auto parts, much more heavily than others.

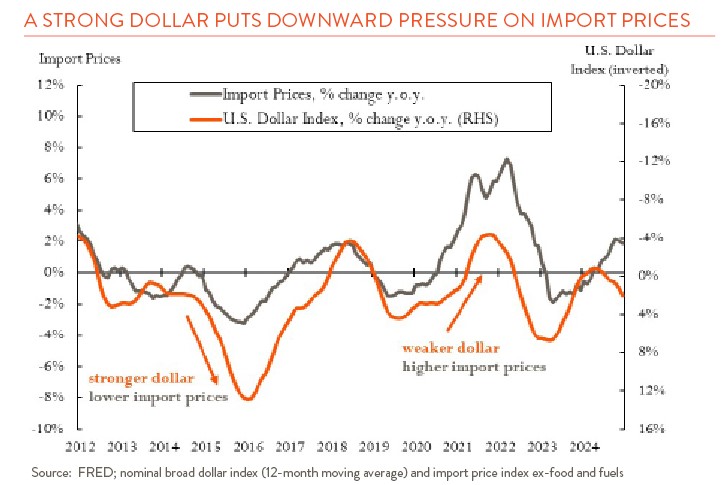

A strong dollar could also play an offsetting role by putting downward pressure on the price of U.S. imports (see chart below). Higher tariffs tend to lead to a stronger dollar as inflation and interest rates rise, making the cost of foreign goods relatively cheaper.

Understandably, much of the discussion today is focused on the near-term economic impact of higher tariffs. But the unintended consequences resulting from our shift to more confrontational and less predictable policies also deserve serious consideration. These include:

A reordering of trade relationships: As our approach to tariffs shifts, so too will our relationship with key trading partners. Mexican auto parts manufacturers, finding themselves with excess production capacity may, for example, enter into supply relationships with Chinese car companies seeking broader access to the Latin American car market. Or consider the case of Canadian oil producers. Historically, U.S. companies have purchased the vast majority of Canada’s oil exports. In reaction to rising tariffs, Canadian oil producers may consider diverting exports to Asian markets using either recently expanded or new pipeline capacity. More generally, a more confrontational approach to trade (and existing trade agreements) may encourage global suppliers to alter their relationships in ways that may not favor us either economically or politically.

A hit to innovation: Trade barriers have long been used to protect domestic companies from foreign competition. If carefully enacted, and with the right additional incentives in place, these policies can give domestic firms the time and resources needed to catch up. But they also can have unintended effects. It is interesting to note, for example, that recent Chinese darling, DeepSeek, developed its groundbreaking approach to AI partly in response to U.S.-imposed trade barriers. Often, firms sheltered from competition have little incentive to produce better or cheaper products and the protection provided simply leads to lost productivity and higher prices. The uncertainty caused by shifting trade policies will also do little to encourage investment, a key ingredient of any innovative process.

Economists across the political spectrum generally agree that a prolonged, retaliatory trade war would result in significantly higher prices and reduced output. For this reason, I am somewhat optimistic that this outcome will be avoided. But caution is warranted. Global trade arrangements are complex and include a diverse array of participants with different political and economic agendas. How these partners adjust to our fundamental policy shift remains an open question.