If you live in Vermont, you’ve likely noticed a growing number of recreational dispensaries appearing throughout the state. Recreational cannabis was legalized in 2018 and retail sales began in 2022. Two years on, how has the rollout been shaping up?

It turns out, we are not the only ones wondering. Vermont’s Cannabis Control Board (CCB) oversees the industry with a mandate to ensure product safety, enforce compliance, and support small businesses and sustainability. The CCB recently announced a temporary halt on issuing new retail and certain cultivation licenses. Shortly after, it also issued a request for proposals to reevaluate the state’s cannabis regulatory framework. Clearly, the CCB is undergoing a stock-taking, but before we get to what is behind the pause, let’s review some of the numbers.

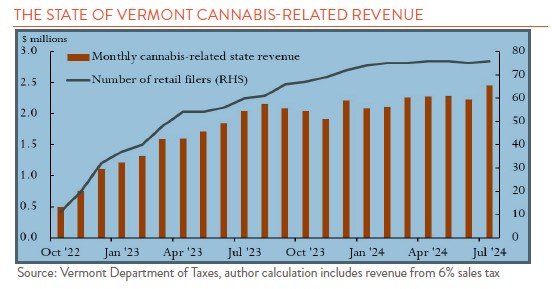

The industry has grown rapidly since 2022. According to the latest state data through July 2024, there are 76 retail tax filers supported by 395 cultivation licensees. On the demand side, cannabis sales reached $131 million over the past year. Cannabis carries a 14% excise tax on top of the regular 6% sales tax, and that has meant major money for the state—around $2.5 million in cannabis-related revenue just in July (see chart below). That puts the state on track for nearly $30 million in tax revenue in 2024. The excise tax alone now generates more revenue than the state’s alcoholic beverages tax (which, to be fair, is lower and only applies to sales for immediate consumption).

If these figures are surprising to you, you may also be surprised to learn that Vermont’s per capita marijuana use is the highest in the country. According to the Substance Abuse and Mental Health Services Administration, a government agency, an estimated 34% of Vermonters aged 18 and older used marijuana in the past year. The national average is 21%.

Sales are booming and the state is making a lot of money, so why is the CCB worried? Initial concerns regarding crime and safety seem to have been largely manageable. While the Department of Health has yet to put out a report on the health impact of legalization, 30% of cannabis tax revenue is allocated to abuse prevention programs. Instead, it seems the CCB is chiefly concerned with oversaturation and distribution.

During the initial rollout, towns voted individually on whether to allow recreational dispensaries (and whether to impose an optional 1% local tax). While this gave localities control, it has led to uneven distribution. For example, Burlington has 12 retail locations, while neighboring South Burlington, which voted against it, has none. In addition, the growth in cultivation licenses has led to concerns of overcrowding. New legislation has asked the CCB to improve the geographic distribution to better reflect local market needs.

The CCB also is assessing the impact that potential changes at the Federal level might have. While cannabis is legal for recreational use in 24 states, nationally it remains a Schedule 1 drug, which carries with it the most stringent restrictions. The classification limits access to banking services and means dispensaries must operate in cash. Significant efforts are underway to reschedule cannabis to Schedule III, which would allow cannabis businesses to claim standard tax deductions and improve access to banking services. The CCB wants to evaluate how re-scheduling might impact interstate commerce and local market structure.

One of the CCB’s priorities is social equity, which it acts on by providing technical assistance and grant funding to licensees from communities disproportionately affected by cannabis prohibition. Industry groups have been vocal about supporting these initiatives as the industry grows to ensure their success and long-term viability. The Chair of the Cannabis Retailers Association of Vermont recently emphasized the importance of continued investment in programs like the Cannabis Business Development Fund, which offers grants and loans to social equity applicants.

While the high-level numbers tell a successful story about the state of cannabis in Vermont, there also have been growing pains. The fact is the industry is only two years old and there is still so much we do not understand. The CCB’s pause on expansion aims to get a better grasp on how to cultivate a nascent industry.