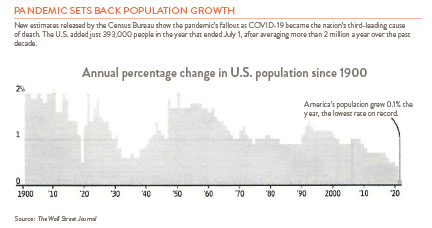

Over the year ending last July, the U.S. population grew by the smallest amount (+0.12%) since records began. Births exceeded deaths by 148,000, and net immigration (foreigners coming vs. going) added 245,000. Deaths increased as COVID became the third biggest killer in the country, and many births were probably delayed due to the pandemic.

The birth drought is probably not just a short-term phenomenon. The total fertility rate, the number of children women will have over their lifetime, has been coming down worldwide, and in the U.S., it has fallen from 2.1, the needed replacement rate, to 1.64 over the past 15 years.

Immigration has added population, but it too has fallen from an average of 500,000 to 1 million a year, due both to COVID and changing government policies. It’s interesting to note that even with slower immigration, the foreign-born portion of the population has risen to 14.1%, close to the all-time high of 14.8% registered in 1890. And America is now majority non-white under the age of 18, which is a change. The new immigrants to America also have a different makeup, with Asians outnumbering those from Latin America.

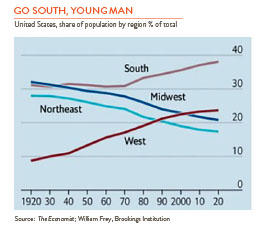

The population slowdown has been accompanied by a geographic reshuffling. People are leaving large, congested, expensive cities for sunny, low tax, business-friendly areas (see chart right). So far, the biggest losers are New York, Chicago, and San Francisco. Sociologists see early signs, although this is murky stuff at best, that we are becoming more like Europe: slow-growing, less religious, less optimistic, and less willing to move. Although there is a shift from the coasts to Sunbelt states, only 10% of Americans moved in 2019, historically a low figure.

So, what are the consequences of slowing population growth? It could mean slower economic growth. Many economists consider the U.S. steady-state growth rate to be 3% a year. You get to this by combining the growth in population and workers (historically about 1% per year) with an increase in productivity (an average of 2% per year, although volatile). So, with slower GDP growth you could see slower profit growth, slower income growth, and slower stock market growth.

Whoa, whoa, whoa. Let’s not get ahead of ourselves. The population of the U.S is still growing; it’s not shrinking like Russia, Japan, and parts of Europe, and there are other positives to slower growth, like less carbon emissions, more education for fewer workers, and more opportunities for immigrants, women, and the poor. But slower population growth is now a worldwide phenomenon and must be factored into our longer-term thinking.